Giugliano, Ferdinando, (2017), “Draghi’s Right to Keep His Foot on the Gas”, Bloomberg View, 28 Απριλίου Since becoming president of the European Central Bank, Mario Draghi has rarely looked as relaxed as he did in Thursday’s press conference. It’s not hard to see why: The euro-zone economy is gathering speed, confidence is soaring, and unemployment is tumbling. The recovery is also spreading across the region, reducing the risk that some …Read More

Surveying Corporate Investment Activities, Needs and Financing in the EU

European Investment Bank Investment Survey 2016/2017 (EIBIS), (2017), “Surveying Corporate Investment Activities, Needs and Financing in the EU”, European Investment Bank (EIB), 10 Απριλίου 2017 Business investment is recovering across Europe. SMEs and firms active in the construction sector and service sector expect an expansion from relatively low levels of investment activities; whereas large firms, manufacturing firms and firms active in the infrastructure sector expect an expansion from already relatively …Read More

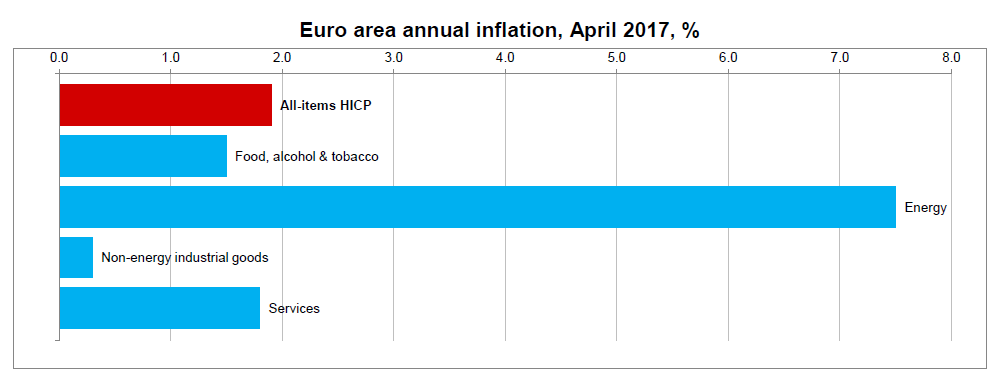

Euro area annual inflation up to 1.9%

Eurostat/Euro area annual inflation up to 1.9% /28 Απριλίου 2017 Euro area annual inflation is expected to be 1.9% in April 2017, up from 1.5% in March 2017, according to a flash estimate from Eurostat, the statistical office of the European Union. Looking at the main components of euro area inflation, energy is expected to have the highest annual rate in April (7.5%, compared with 7.4% in March), followed by …Read More

For A Treaty Democratizing Euro Area Governance

Hennette, Stéphanie, Sacriste, Thomas Piketty Guillaume, Vauchez, Antoine, (2017), “For A Treaty Democratizing Euro Area Governance”, Social Europe, 27 Απριλίου Over the last ten years of economic and financial crisis, a new centre of European power has taken shape: the ‘government’ of the Euro Area. The expression may seem badly chosen as it remains hard to identify the democratically accountable ‘institution’ which today implements European economic policies. We are indeed aiming …Read More

Why Europe Still Needs Cash

Mersch, Yves, (2017), “Why Europe Still Needs Cash”, Project Syndicate, 26 Απριλίου Non-cash payment options have been proliferating in recent years. Credit cards, online transfers, and direct-debit payments are already well established. Now, smartphone-enabled digital-payment solutions and mobile wallets are also gaining ground. The emergence of potentially disruptive innovations like distributed ledger technologies indicate that further and possibly fundamental change may be on the horizon. Independent of these new and incipient …Read More

The global decline in the labour income share: is capital the answer to Germany’s current account surplus?

Berger, Ennet, Wolff, Guntram B., (2017), “The global decline in the labour income share: is capital the answer to Germany’s current account surplus?”, Bruegel, 26 April There are two broad views of adjustment in Europe’s economic and monetary union. The first is that the divergence of competitiveness in the euro area is the fault of the peripheral countries, which were guilty of “losing their competitiveness simply by becoming too expensive” prior …Read More

Exchange rate prediction redux

Cheung, Yin-Wong, Chinn, Menzie , Pascual, Antonio Garcia, Zhang, Yi, (2017), “Exchange rate prediction redux”, Vox Eu, 27 Απριλίου Over the past decade, advanced economy exchange rates have exhibited substantial variability, even as conventional empirical determinants – such as interest rates and inflation – have remained fairly stable. At the same, the Global Crisis was associated with unprecedented levels of risk and illiquidity, with obvious effects on financial markets. These developments …Read More

ECB Meeting Comes at a Precarious Time for Markets

Emons, Ben, (2017), “ECB Meeting Comes at a Precarious Time for Markets”, Bloomberg View, 25 Απριλίου The recent economic data out of the euro zone is encouraging. Production, manufacturing and confidence are robust, and inflation has stabilized. That’s not to say that there aren’t risks to the downside, such as growing populism, global geopolitical tensions, and uncertainty about sustainability of the economic recovery. To insure against these risks, the European …Read More

The European Fund for Strategic Investments as a New Type of Budgetary Instrument

Rinaldi, David, Núñez Ferrer, Jorge, (2017), “The European Fund for Strategic Investments as a New Type of Budgetary Instrument”, CEPS Research Report No 2017/07, 5 Απριλίου This paper provides an overview of the European Fund for Strategic Investments (EFSI) as a budgetary instrument. A preliminary analysis of the quantitative impact of its first year and a half of activity is complemented by an outline of the corollary policies that can …Read More

Ισλανδία: Τριγμοί μετά την άρση των capital controls

Η Καθημερινή, (2017), “Ισλανδία: Τριγμοί μετά την άρση των capital controls”, 25 Απριλίου 2017 Τις δυσκολίες που συνεπάγεται η προσπάθεια μιας χώρας να απεμπλακεί από τους ελέγχους στις κινήσεις κεφαλαίων, όταν αυτοί έχουν επιβληθεί σε κατάσταση εκτάκτου ανάγκης, αποτελεί η περίπτωση της Ισλανδίας και η τύχη του νομίσματός της, της ισλανδικής κορώνας. Λίγες εβδομάδες μετά την άρση των ελέγχων στις κινήσεις κεφαλαίων, που επί οκτώ χρόνια είχαν περιφρουρήσει το ισλανδικό …Read More