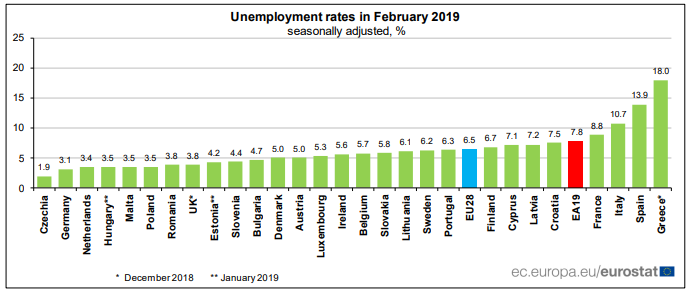

Eurostat/Euro area unemployment at 7.8%/1 Απρίλιου 2019 The euro area (EA19) seasonally-adjusted unemployment rate was 7.8% in February 2019, stable compared with January 2019 and down from 8.5% in February 2018. This remains the lowest rate recorded in the euro area since October 2008. The EU28 unemployment rate was 6.5% in February 2019, stable compared with January 2019 and down from 7.1% in February 2018. This remains the lowest rate …Read More

A Delicate Moment for the Global Economy: Three Priority Areas for Action

Christine Lagarde, (2019), “A Delicate Moment for the Global Economy: Three Priority Areas for Action”, IMF, 2 Απριλίου In January, the IMF projected global growth for 2019 and 2020 at around 3 ½ percent—less than in the recent past, but still reasonable. It has since lost further momentum, as you will see from our updated forecast next week. Only two years ago, 75 percent of the global economy experienced an …Read More

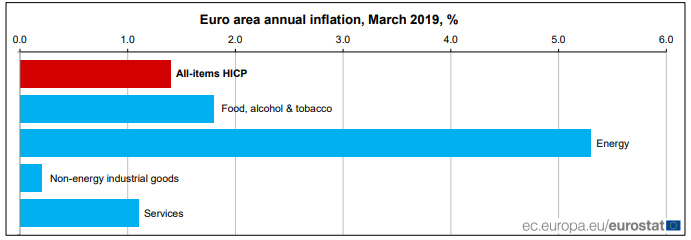

Euro area annual inflation down to 1.4%

Eurostat/Euro area annual inflation down to 1.4%/1 Απριλίου 2019 Euro area annual inflation is expected to be 1.4% in March 2019, down from 1.5% in February according to a flash estimate from Eurostat, the statistical office of the European Union. Σχετικές Αναρτήσεις Eurostat/Euro area annual inflation up to 1.5%/1 Μαρτίου 2019 Eurostat/Annual inflation down to 1.4% in the euro area /22 Φεβρουαρίου 2019

Macroprudential policy in a monetary union with cross-border banking

Matthieu Darracq Pariès, Christoffer Kok and Elena Rancoita, (2019), “Macroprudential policy in a monetary union with cross-border banking”, ECB Working Paper Series No2260, Μάρτιος 2019 We analyse the interaction between monetary and macroprudential policies in the euro area by means of a two-country DSGE model with financial frictions and cross-border spillover effects. We calibrate the model for the four largest euro area countries (i.e. Germany, France, Italy, and Spain), with …Read More

Με 94 εκατ. ευρώ ανά ώρα «τρέχει» η φοροδιαφυγή στην Ευρώπη

Η Καθημερινή, (2019), “Με 94 εκατ. ευρώ ανά ώρα «τρέχει» η φοροδιαφυγή στην Ευρώπη”, 30 Μαρτίου Στο δυσθεώρητο ποσό των 2,25 δισ. ευρώ την ημέρα ανέρχεται συνολικά η φοροδιαφυγή των Ευρωπαίων, σύμφωνα με έρευνα του Ευρωπαϊκού Κοινοβουλίου, με την Ελλάδα να έρχεται έβδομη ανάμεσα στα 28 κράτη-μέλη της Ε.Ε., με κριτήριο την κατά κεφαλήν φοροδιαφυγή. Από την εν λόγω έρευνα προκύπτει πως το ποσό που στερούν οι Ελληνες από τα …Read More

What if Zero Interest Rates Are the New Normal?

Adair Turner, (2019), “What if Zero Interest Rates Are the New Normal?”, Project Syndicate, 29 Μαρτίου The valid insight behind “modern monetary theory” – that governments and central banks together can always create nominal demand – was explained by Milton Friedman in 1948. But it is vital also to understand that excessive monetary finance is hugely harmful, and it is dangerous to view it as a costless way to solve …Read More

On the credit and exchange rate channels of central bank asset purchases in a monetary union

Matthieu Darracq Pariès and Niki Papadopoulou, (2019), “On the credit and exchange rate channels of central bank asset purchases in a monetary union “, ECB Working Paper Series No 2259, Μάρτιος Through the euro area crisis, financial fragmentation across jurisdictions became a prime concern for the single monetary policy. The ECB broadened the scope of its instruments and enacted a series of non-standard measures to engineer an appropriate degree of …Read More

The Euro Area: Creating a Stronger Economic Ecosystem

Christine Lagarde, (2019), “The Euro Area: Creating a Stronger Economic Ecosystem”, IMF, 28 Μαρτίου Twenty years ago, European countries did not just plant one tree, they planted an entire forest—creating a new economic ecosystem known as the euro area. The fundamental strength of that system lies in its interconnectedness and diversity—a combination that can help Europe to fully unlock its immense economic potential. Σχετικές Αναρτήσεις Jan Priewe, (2019), «Could Europe …Read More

Αυξάνονται οι πιθανότητες του δυσμενούς σεναρίου για τις τράπεζες στην Ευρωζώνη

Γ. Αγγέλη, (2019), “Αυξάνονται οι πιθανότητες του δυσμενούς σεναρίου για τις τράπεζες στην Ευρωζώνη”, capital.gr, 29 Μαρτίου Σε χθεσινή ομιλία του στη Φρανκφούρτη ο απερχόμενος τον Οκτώβριο πρόεδρος της ΕΚΤ Μάριο Ντράγκι, δεν δίστασε να επαναλάβει την προσωπική ανησυχία του για την οικονομία της Ευρωζώνης πρώτον “εάν η εξωτερική ζήτηση πρόκειται να παραμείνει αδύναμη και δεύτερον εάν αυτό πρόκειται να επεκταθεί και στην εσωτερική (σ.σ. στην Ευρωζώνη) ζήτηση.” Σχετικές Αναρτήσεις …Read More

The European Union’s response to the trade crisis

Uri Dadush and Guntram Wolff, (2019), “The European Union’s response to the trade crisis”, Bruegel, Policy Contribution, Issue No 5, Μάρτιος The global trading system, a source of prosperity, is under attack on various fronts. The causes run deep and require a strategic response from the European Union and from the main trading nations. The future of the system hinges on the answer to three questions, and the scenarios associated …Read More