Lucrezia Reichlin, (2019), “The Eurozone’s Real Weakness”, Project Syndicate, 28 Μαρτίου A new eurozone crisis would most likely have a less uneven effect than in 2008 or 2011, not least because its largest economies are currently weak. But if a recession hits, policymakers will find it hard to mount an effective response. Σχετικές Αναρτήσεις Jan Priewe, (2019), «Could Europe face the next recession?», Social Europe, 19 Μαρτίου Paul Taylor, (2019), «Why …Read More

Why non-performing loans are still putting the European Banking Union at risk

Corrado Macchiarelli, Renato Giacon, Andromachi Georgosouli and Mara Monti, (2019), “Why non-performing loans are still putting the European Banking Union at risk”, LSE EUROPP, 27 Μαρτίου Non-Performing Loan (NPL) ratios in countries like Italy, Portugal and Spain have started to decrease sharply, but as Corrado Macchiarelli, Renato Giacon, Andromachi Georgosouli and Mara Monti write, this has received relatively little media attention in comparison to previous fears over the accumulation of …Read More

Restoring trust in Europe—wage rises and workplace democracy

Steve Coulter, (2019), “Restoring trust in Europe—wage rises and workplace democracy”, Social Europe, 27 Μαρτίου Europe’s economy has been expanding for six straight years and more people are getting jobs. The crisis is fading from memory and austerity is easing off. So why aren’t Europeans happier? And why, in all but three countries surveyed recently by Eurobarometer (Figure 1), is trust in the European Union below what it was before …Read More

Monetary policy in times of uncertainty: a reappraisal of the Brainard principle

Giuseppe Ferrero, Mario Pietrunti and Andrea Tiseno, (2019), “Monetary policy in times of uncertainty: a reappraisal of the Brainard principle”, VoxEU, 21 Μαρτίου Dealing with uncertainty about the state of the economy is one of the main challenges facing monetary policymakers. In recent years there has been an extensive debate on the value of some of the deep parameters driving the economy, such as the natural rate of interest and …Read More

Πώς η Κύπρος ξεπέρασε την κρίση κι έγινε επενδυτικός μαγνήτης

Δημήτρη Δεβελέγκου, (2019), “Πώς η Κύπρος ξεπέρασε την κρίση κι έγινε επενδυτικός μαγνήτης”, Capital.gr, 27 Μαρτίου Η παροχή κινήτρων σε ξένους υψηλής εισοδηματικής κατηγορίας ή σε εξαιρετικά εύπορα άτομα, γνωστά ως Ultra High Net Worth Individuals (UHNWI), για την μεταφορά της φορολογικής κατοικίας αποτελεί την πλέον επιτυχημένη “φόρμουλα” για την εμφάνιση υψηλών ρυθμών ανάπτυξης και την προσέλκυση επενδυτών. Στη διαπίστωση αυτή καταλήγουν παράγοντες της αγοράς, που τονίζουν ότι το επόμενο κυβερνητικό …Read More

How the story of Britain and Europe began: Was Brexit inevitable?

Lindsay Aqui, (2019), “How the story of Britain and Europe began: Was Brexit inevitable?”, LSE EUROPP, 26 Μαρτίου How did the story of Britain and Europe begin? Was Brexit inevitable? In this blog, Lindsay Aqui attempts to answer these and other questions as the UK’s protracted departure from the European Union enters yet another phase. Σχετικές Αναρτήσεις Josh De Lyon and Swati Dhingra, (2019), «UK economy since the Brexit vote: …Read More

UK economy since the Brexit vote: slower GDP growth, lower productivity, and a weaker pound

Josh De Lyon and Swati Dhingra, (2019), “UK economy since the Brexit vote: slower GDP growth, lower productivity, and a weaker pound”, LSE EUROPP, 22 Μαρτίου Evidence of the UK’s economic performance since the EU Referendum is clear: GDP growth has slowed down, productivity has suffered, the pound has depreciated and purchasing power has gone down, and investments have declined. In this blog, Josh De Lyon and Swati Dhingra argue …Read More

Could Europe face the next recession?

Jan Priewe, (2019), “Could Europe face the next recession?”, Social Europe, 19 Μαρτίου That the eurozone is incomplete is an assessment shared by almost all economists and economic policy-makers. The prevailing opinion is that the European banking union is the most important missing part, in connection with a capital-markets union. A recent book, Still Time to Save the Euro, published by Social Europe, addresses six key economic problems which are …Read More

Η FED, η ΕΚΤ και το «ντόμινο» των επιτοκίων

Νατάσα Στσινού, (2019), “Η FED, η ΕΚΤ και το «ντόμινο» των επιτοκίων”, naftemporiki.gr Η Fed έστειλε μήνυμα ότι παγώνει τις αυξήσεις των επιτοκίων τουλάχιστον για φέτος και ενδεχομένως για περισσότερο και η ΕΚΤ όχι μόνο δεν είναι έτοιμη για ομαλοποίηση της πολιτικής της, αλλά σχεδιάζει νέο γύρο φθηνών δανείων για τις τράπεζες και πολλοί πιστεύουν ότι σύντομα θα εξετάσει και την επανενεργοποίηση του προγράμματος ποσοτικής χαλάρωσης (QE), που τερμάτισε μόλις …Read More

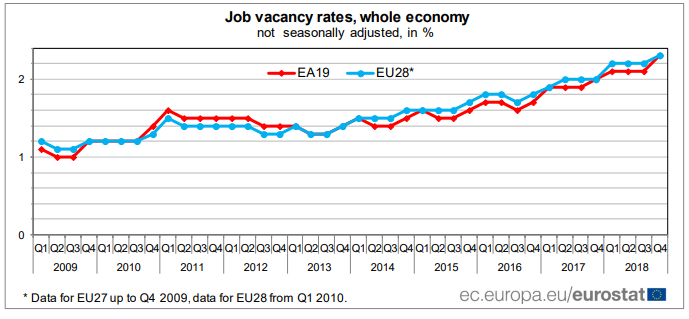

Euro area and EU28 job vacancy rates at 2.3%

Eurostat/Euro area and EU28 job vacancy rates at 2.3%/18 Μαρτίου 2019 The job vacancy rate in the euro area (EA19) was 2.3% in the fourth quarter of 2018, up from 2.1% in the third quarter of 2018 and from 2.0% in the fourth quarter of 2017, according to figures published by Eurostat, the statistical office of the European Union. In the EU28, the job vacancy rate was also 2.3% in …Read More