Jimeno, Juan, (2015), “Long-lasting consequences of the European crisis”, ECB Working Paper Series, No 1832 / July 2015 The Great Recession and the subsequent European crisis may have long-lasting effects on aggregate demand, aggregate supply, and, hence, on macroeconomic performance over the medium and long-run. Besides the fact that financial crisis last longer and are succeeded by slower recoveries, and apart from the hysteresis effects that may operate after episodes of long-term unemployment, the combination of high …Read More

Does Banking Union Worsen the EU’s Democratic Deficit? The Need for Greater Supervisory Data Transparency

Gandrud, Christopher, Hallerberg, Mark, (2015), “Does Banking Union Worsen the EU’s Democratic Deficit? The Need for Greater Supervisory Data Transparency”, Journal of Common Market Studies, Volume 53, Issue 4, Pages 703–935, July 2015 Does banking union exacerbate the European Union’s democratic deficit? Using Scharpf’s ‘input’ and ‘output’ legitimacy concepts, it is argued in this article that its design does worsen the democratic deficit. There are good reasons to limit ‘input legitimacy’ for …Read More

France, Germany and the New Framework for EMU Governance

Maris, Georgios, Sklias, Pantelis, (2015), “France, Germany and the New Framework for EMU Governance”, Journal of Contemporary European Studies, Vol.23, Issue 2, 13 Ιουλίου The European crisis is the best case study for examining both the vulnerabilities of Europe’s framework for economic governance and the very process of European integration itself. This statement is true for several reasons: first, because the European crisis is the most serious crisis the European …Read More

The political economy of financial crisis policy

Terzi, Alesio, O’ Keeffe, Michael, (2015), “The political economy of financial crisis policy”, Bruegel publications, 8 Ιουλίου Government intervention to stabilise financial systems in times of banking crises ultimately involves political decisions. This paper sheds light on how certain political variables influence policy choices during banking crises and hence have an impact on fiscal outlays. We employ cross-country econometric evidence from all crisis episodes in the period 1970-2011 to examine …Read More

Germany and the Eurozone Crisis: Between Hegemony and Domestic Politics

Βulmer, S., (2014), “Germany and the Eurozone Crisis: Between Hegemony and Domestic Politics”, West European Politics, Vol. 37, Issue 6, pp. 1244-1263. This paper explores Germany’s centrality to the outcome of the eurozone crisis. It argues that the eurozone crisis has led Germany’s ordo-liberal principles to trump its other longstanding commitment – i.e. to European integration. These two principles are explored in order then to shed light on how they …Read More

Varieties of Capitalism and the Euro Crisis

Hall, P. (2014), “Varieties of Capitalism and the Euro Crisis”, West European Politics, Vol. 37, Issue 6, pp. 1223-1243. This article examines the role played by varieties of capitalism in the euro crisis, considering the origins of the crisis, its progression, and the response to it. Deficiencies in the institutional arrangements governing the single currency are linked to economic doctrines of the 1990s. The roots of the crisis are linked …Read More

From ‘Tiger’ to ‘PIIGS’: Ireland and the use of heuristics in comparative political economy

Brazys, S. & Hardiman, N., (2015), “From ‘Tiger’ to ‘PIIGS’: Ireland and the use of heuristics in comparative political economy”, European Journal of Political Research, Vol.54, Issue 1, pp. 23-42. This article analyses the consequences of the narrative construction of the group of countries that has been grouped as ‘PIIGS’ (Portugal, Ireland, Italy, Greece and Spain) for their sovereign debt risk rating. Acronyms for groups of countries can provide a …Read More

Still a regulatory state? The European Union and the financial crisis

Caporaso, James, Kim, Min-hyung, Durrett, Warren, (2015), “Still a regulatory state? The European Union and the financial crisis”, Journal of European Public Policy, Volume 22, Issue 7, 6 Δεκεμβρίου 2014. The European Union (EU) has been conceptualized as a regulatory state, i.e., an emerging polity that differs from the classic Westphalian state. Unable to engage in redistribution and stabilization, the EU has specialized in a range of regulatory functions related to market creation …Read More

The role of trade credit financing in international trade

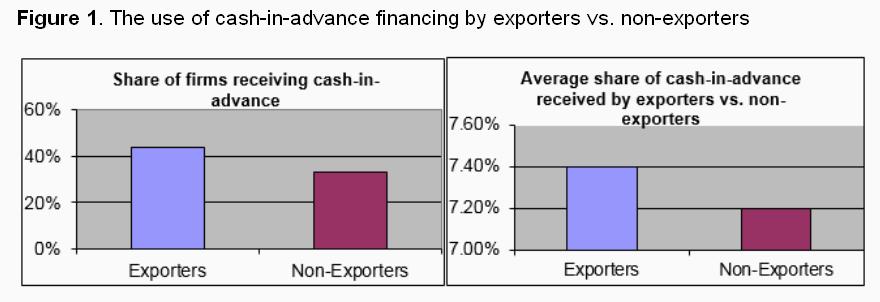

Eck, K, Engemann, M. & Schnitzer, M. (2015) “The role of trade credit financing in international trade“, VoxEU Organisation, 20 Απριλίου 2015. Credits extended bilaterally between firms, so called trade credits, are particularly expensive yet many firms use it, especially for international transactions. This column argues that such cash-in-advance financing serves as a credible signal of quality. Data from a unique survey of German firms show that it fosters …Read More

Three waves of convergence. Can Eurozone countries start growing together again?

Buti, M. & Turrini, A. (2015) “Three waves of convergence. Can Eurozone countries start growing together again?“, VoxEU Organisation, 17 Απριλίου. An oft expressed view is that the Eurozone is a straitjacket on periphery members and income convergence has slowed, halted or reversed. This column argues that EZ convergence never stopped. What changed was the type of convergence. Today’s convergence is neither nominal nor real, it is structural. Structural …Read More