Eck, K, Engemann, M. & Schnitzer, M. (2015) “The role of trade credit financing in international trade“, VoxEU Organisation, 20 Απριλίου 2015.

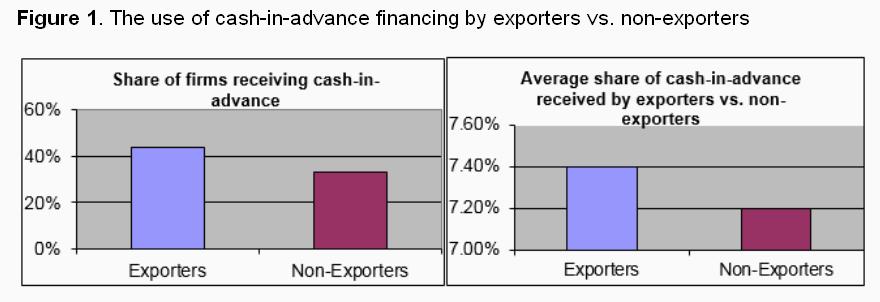

Credits extended bilaterally between firms, so called trade credits, are particularly expensive yet many firms use it, especially for international transactions. This column argues that such cash-in-advance financing serves as a credible signal of quality. Data from a unique survey of German firms show that it fosters export participation in particular for firms that tend to have the greatest difficulties in entering foreign markets.

According to a survey by the IMF (2009), about 60% of all international trade transactions are financed via trade credits. Trade credits are extended bilaterally between firms and exist in the form of supplier credits and cash-in-advance. A supplier credit is granted from the seller of a good to the buyer such that the buyer can delay the payment of the purchasing price for a certain period of time. Cash-in-advance, in contrast, refers to payments made in advance by the buyer of a good to the seller. The intensive use of inter-firm financing is surprising given that financial intermediaries such as banks are supposed to be more efficient in providing credit to firms. Inter-firm financing is considered rather expensive with implicit annual trade credit interest rates amounting up to 40% (Petersen 1997).

Prevalence of inter-firm financing in international trade

The literature on trade credits provides various explanations why firms rely on trade credit financing. Lee (1993) and Long (1993), for example, have developed the warranty for quality hypothesis according to which firms extend a supplier credit to signal product quality to their (domestic) customers. Klapper, Laeven and Rajan (2011) provide empirical evidence that less trustworthy suppliers offer longer payment periods to their buyers. Only recently has the literature on trade credits taken international transactions into its focus. Schmidt-Eisenlohr (2012), Hoefele et al. (2012) and Antras and Foley (2011), for example, investigate the optimal choice of trade credit in international transactions. Auboin and Engemann (2014), Olsen (2011) and Glady and Potin (2011) deal with the question how bank-intermediated trade finance such as export credit insurance and letters of credit affect international trade. Why trade credits are so prevalent in international trade, despite their high cost, has been little studied so far.

Σχετικές αναρτήσεις:

- Cukierman, Α. (2015) “The Crisis and the renminbi’s international role“, VoxEU Organisation, 07 Ιανουαρίου.

- Meltzer, P. J. (2014) “The Importance of the Internet and Transatlantic Data Flows for US and EU Trade and Investment“, Global Economy & Development – Brookings Institute, Working Paper 79, Οκτώβριος 2014.

- Goldberg, L., Krogstrup, S. & Rey, H. (2014) “Why is financial stability essential for key currencies in the international monetary system?“, VoxEU Organisation, 26 Ιουλίου.