Mitchell, B. (2014) “Yet another solution for the Eurozone“, Bill Mitchell Blog: Modern Monetary Theory… Macroeconomic Reality, 25 Σεπτεμβρίου.

The basis of a fiat currency, which is issued under monopoly conditions by the government and has no intrinsic value (unlike say gold or silver currencies) is that it is the only unit that the non-government sector can use to relinquish its tax and related obligations to the government. That property immediately makes the otherwise worthless token valuable and demanded. If there was no capacity to use the currency for this purpose then why we would agree to use the government’s preferred currency? Recently, some economists in Italy have come up with a hybrid scheme to save the euro yet allow Italy to resume growth without violating the rules governed by the Stability and Growth Pact and without the ECB violating its no bailout clause, even though both violations have occurred in the last 5 years and been overlooked by the elites. The plan is similar to that proposed in 2009 by the Government in California. It has merit but ultimately misses the point. The Eurozone problem is the euro!

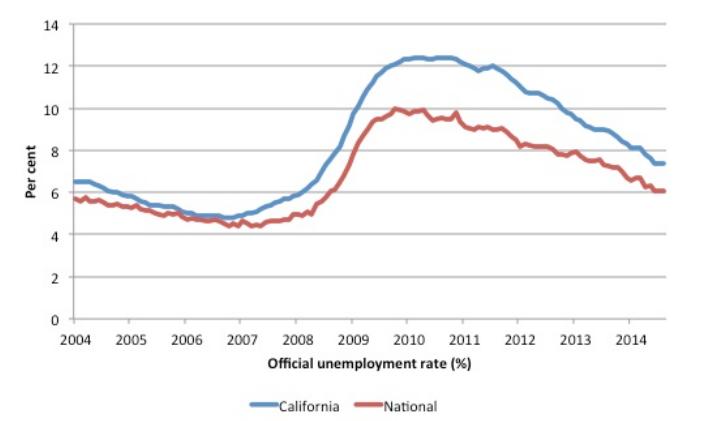

Regular (long standing readers) might recall that in 2009, I proposed that the then Governor of California issue its own currency to overcome its fiscal crisis at the time.

Please read my blog – California IOUs are not currency … but they could be! – for more discussion on this point. I followed up the conceptual outline of the idea with – My letter to the Governor (arnie)

I noted that California’s fiscal deterioration was particularly severe in 2009. The deficit ($US24.3 billion) rose after economic activity ground to a halt and tax revenue fell off a cliff.

Data from the State Controllers Office, which is California’s independent fiscal watchdog, clearly demonstrated the cash crisis that the State was facing. Unlike a national government, which issues the currency and could never run out of it, California could face a situation where it would not be able to pay its bills (in USD).

For any state or local government (that is, one that uses the currency of the nation but does not have the capacity to issue it), any fiscal deficit has to be ‘funded’ because this level of government always faces a revenue constraint.

Such a government has to increase taxes, cut spending or increase its borrowing (state debt issuance) to resolve the fiscal deterioration.

As a general observation, it is madness for such a government to attempt to use discretionary policy changes to ‘fight against’ the automatic stabilisers (the cyclical loss of tax revenue as its economy deteriorates).

Trying to resolve a burgeoning ‘state’ fiscal deficit by increasing taxes and cutting spending at the height of a major economic downturn is not recommended if: (a) the aim is to return to growth as quickly as possible, and (b) actually bring the cash shortfall back into manageable dimensions.

Σχετικές αναρτήσεις:

- Giavazzi, F. & Tabellini, G. (2014) “What macroeconomic policies for the Eurozone?“, VoxEU Organisation, 25 Σεπτεμβρίου.

- Johnston, A. & Regan, A. (2014) “The absence of national adjustment tools is the reason why Eurozone countries continue to struggle“, LSE EUROPP, 22 Σεπτεμβρίου.

- Xifré, R. (2014) “No miracles in southern Eurozone without resource reallocation“, VoxEU Organisation, 12 Σεπτεμβρίου.