Summers, L. (2014) “Reflections on the new ‘Secular Stagnation hypothesis’“, VoxEU Organisation, 30 Οκτωβρίου.

The notion that Europe and other advanced economies are suffering secular stagnation is gaining traction. This column by Larry Summers – first published in the Vox eBook “Secular Stagnation: Facts, Causes and Cures” – explains the idea. It argues that a decline in the full-employment real interest rate coupled with low inflation could indefinitely prevent the attainment of full employment.

Just seven years ago all seemed well in the field of macroeconomics. The phrase ‘great moderation’ captured the reality that business cycle volatility seemed way down from levels of the first part of the post war period. A broad methodological consensus supported the use of DSGE (dynamic stochastic general equilibrium) models to understand macroeconomic fluctuations and to evaluate macroeconomic policies. There was widespread support for the idea that the primary concern of independent central banks should be maintaining appropriate inflation targets and reacting to cyclical developments to minimise the amplitude of fluctuations.

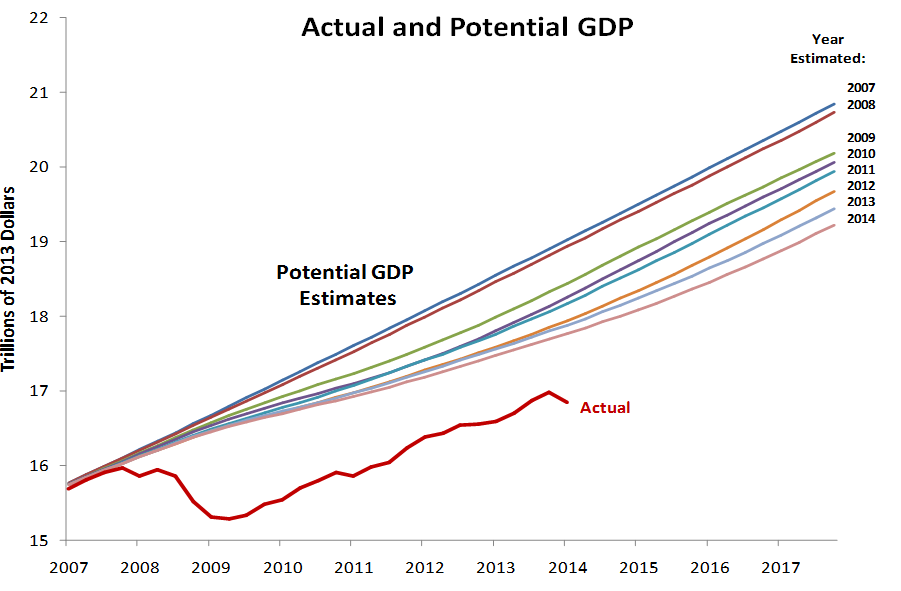

Economic crisis has led to crisis in the field of macroeconomics. The idea that depressions were a concept of only historic interest has been belied by the financial crisis and “Great Recession”. Figures 1a and 1b depicts the gap between actual and potential output estimated as of various dates for both the US and the Eurozone. It is apparent that output is far short of where its potential was expected to be as of 2008. Even more troubling is the observation that most of the gap is expected to represent a permanent loss as potential output has been revised sharply downwards. For the Eurozone, GDP is almost 15% below its 2008-estimated potential and potential output has been written down by almost 10%. As Figure 2 illustrates Europe’s output shortfall is almost identical to the one Japan experienced when the bursting of its ‘bubble economy’ triggered a financial crisis.

Figure 1a. Actual and potential GDP in the US

Σχετικές αναρτήσεις:

- Hugh, E. (2014) “Does The Secular Stagnation Theory Have Any Sort of Validity?“, A Fistful of Euros: European Opinion Blog, 20 Οκτωβρίου.

- Monthly CFM Survey: Secular Stagnation, Centre for Macroeconomic Survey, 03 Οκτωβρίου 2014.

- Teulings, C. & Baldwin, R. (2014) “Secular stagnation: Facts, causes, and cures“, VoxEU Organisation Books, 15 Αυγούστου.