Reinhart, M. C., Trebesch, C. (2014) “Sovereign-debt relief and its aftermath: The 1930s, the 1990s, the future?“, VoxEU Organisation, 21 Οκτωβρίου.

To work towards resolving Europe’s ongoing debt crisis this column looks to the past. From the recent emerging market debt crisis (1980s-2000s) and the interwar episode of the 1920s-1930s we learn that debt write-downs and defaults are able to be postponed but not prevented. Punishment for default is temporary, sometimes followed by a renewed surge in borrowing that leads to another crisis.

Since 2008 Europe has been mired in a combination of economic depression, financial crisis, and public and private debt overhangs. Greece was the first advanced economy to restructure its debt in more than a generation, and the ongoing depression in Europe’s periphery has already surpassed the economic collapse of the 1930s by some markers. In most advanced economies record private debt overhangs are unwinding only slowly, while the steady upward march in public debts continues largely unabated. As a result, the broad subject of sovereign debt crises and the role of debt write-offs in their resolution is no longer a matter of solely academic interest.

This column adds a historical perspective to the small body of work on sovereign debt relief episodes of recent decades (see, in particular, Arslanalp and Henry 2005, Chauvin and Kraay 2005, Dias et al. 2013, Sturzenegger and Zettelmeyer 2007). In Reinhart and Trebesch (2014) we draw lessons from two main historical episodes of sovereign default and debt relief:

- the well-known emerging market debt crises of recent decades (1980s-2000s), and

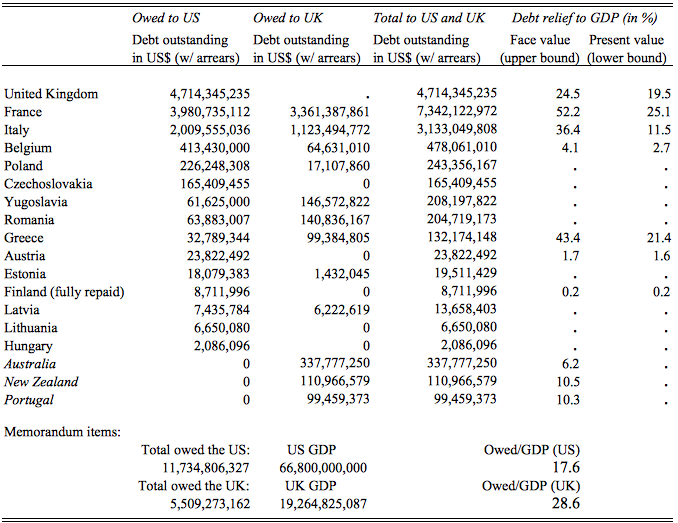

- the lesser-known debt crisis and overhang episode of war-related debt in advanced economies of the 1920s and 1930s, which emerged as a result of WWI and its aftermath.

We collect a new dataset on indebtedness, default and relief for both episodes and then study the economic landscape before and after the resolution of the crises.

Σχετικές αναρτήσεις:

- Joyce, P. J. (2014) “The IMF and Sovereign Debt“, Economonitor–A Roubini Global Economics Project, 09 Σεπτεμβρίου.

- Steinkamp, S. & Westermann, F. (2014) “The role of creditor seniority in Europe’s sovereign debt crisis“. Economic Policy, Vol. 29, Issue 79, pp. 495–552.

- Broner, A. F., Erce, A., Martin, A. & Ventura, J. (2014) “Sovereign debt markets in turbulent times: A view of the European crisis“, VoxEU Organisation, 23 Ιουλίου.