Wren-Lewis, S. (2014) “The mythical Phillips curve?“, Mainly Macro Blog, 14 Οκτωβρίου.

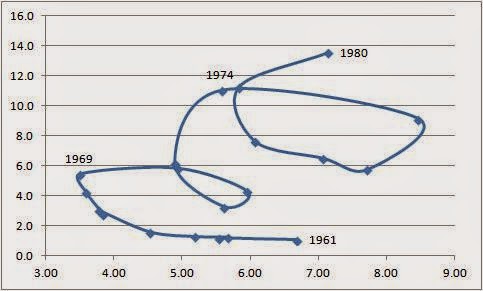

Suppose you had just an hour to teach the basics of macroeconomics, what relationship would you be sure to include? My answer would be the Phillips curve. With the Phillips curve you can go a long way to understanding what monetary policy is all about.

My faith in the Phillips curve comes from simple but highly plausible ideas. In a boom, demand is strong relative to the economy’s capacity to produce, so prices and wages tend to rise faster than in an economic downturn. However workers do not normally suffer from money illusion: in a boom they want higher real wages to go with increasing labour supply. Equally firms are interested in profit margins, so if costs rise, so will prices. As firms do not change prices every day, they will think about future as well as current costs. That means that inflation depends on expected inflation as well as some indicator of excess demand, like unemployment.

Microfoundations confirm this logic, but add a crucial point that is not immediately obvious. Inflation today will depend on expectations about inflation in the future, not expectations about current inflation. That is the major contribution of New Keynesian theory to macroeconomics.

This combination of simple and formal theory would be of little interest if it was inconsistent with the data. A few do periodically claim just this: that it is very hard to find a Phillips curve in the data. (For example here is Stephen Williamson talking about Europe – but see also this from László Andor claiming just the opposite – and this from Chris Dillow on the UK.) If this was true, it would mean that monetary policymakers the world over were using the wrong framework in taking their decisions.

Σχετικές αναρτήσεις:

- Andor, L. (2014) “Re-discovering the Phillips curve“, VoxEU Organisation, 01 Οκτωβρίου.

- Algan, Y., Cahuc, P. & Sangnier, M. (2014) “Trust and the welfare state: The twin-peaked curve“, VoxEU Organisation, 17 Ιουλίου.

- Wren-Lewis, S. (2014) “Has the Great Recession killed the traditional Phillips Curve?“, Mainly Macro Blog, 14 Ιουλίου.