Durden, D. (2014) “The Scariest Number Revealed Today: $1.114 Trillion In Eurozone Bad Debt“, ΘZeroHedge, 26 Οκτωβρίου.

As we previously reported, the ECB’s latest stress test was once again patently flawed from the start. Why? Because as we noted earlier, in its most draconian, “adverse” scenario, the ECB simply refused to contemplate the possibility of deflation. And here’s why. Buried deep in the report, on page 75 of 178, is the following revelation which contains in it the scariest number presented to the public today.

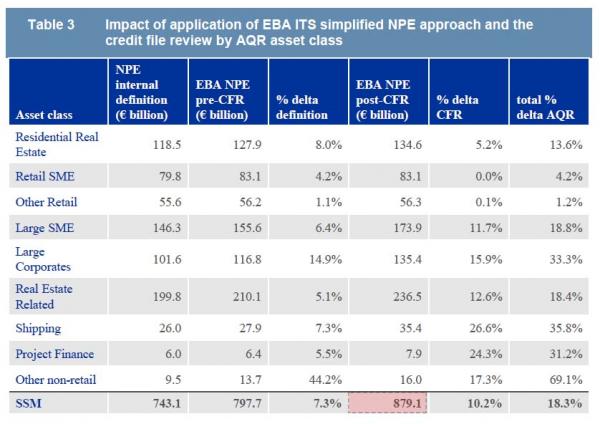

Due to the fact that on average banks’ internal definitions were less conservative than the simplified EBA approach, the application of the simplified approach led to an increase in NPE stock of €54.6 billion from €743.1 billion to €797.7 billion. The CFR and the projection of findings led to an additional increase in NPE of €81.3 billion, resulting in a total increase €135.9 billion to €879.1 billion of post-CFR NPEs across the participating banks as a result of the AQR. The impact of the application of the EBA simplified approach and the credit file review on the stock of NPEs varied amongst debtor geographies, with overall increases among SSM debtor geographies ranging from 7% to 116%.

Translated: due to a lotta ins, lotta outs, lotta what-have-you’s, and the now traditional “fluidity” when it comes to European term definitions (recall that as of this year, in Europe hookers and blow contribute to (estimated) GDP otherwise the Eurozone would be in deep triple-dip recession, if not outright depression by now) the stress test, while concluding that Europe’s banks are “safe”, also uncovered some €136 billion in previously undisclosed NPE or “Non-Performing Exposure”, aka Bad Loans – loans which will never be repaid.

Σχετικές αναρτήσεις:

- Pâris, P. and Wyplosz, Ch. (2014) “PADRE: Politically Acceptable Debt Restructuring in the Eurozone“, 28 Ιανουαρίου.

- Wyplosz, C. (2013)”Messing up the next Greek debt relief could endanger the Eurozone“, VoxEU Organisation, 23 Σεπτεμβρίου.

- Pâris, P., Wyplosz, Ch. (2013) “To end the Eurozone crisis, bury the debt forever“, VoxEU Organisation, 6 Αυγούστου.