Dolan, E. (2014) “Why Should Europe (or Anyone Else) Fear Deflation?“, Economonitor Blog, 20 Οκτωβρίου.

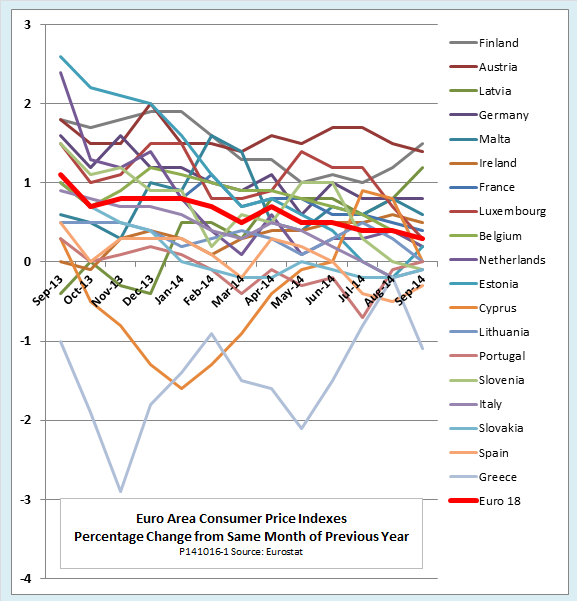

Europe is fearful as it teeters on the brink of deflation. As the chart shows, September consumer prices in the eurozone were just 0.3 percent higher than in the same month a year earlier. That is far below the 2 percent inflation target set by the European Central Bank (ECB). Five countries were already experiencing deflation, and inflation was at zero in three others.

Still, despite all the gloomy deflation headlines, the most common question I get about deflation is, “So what?” If inflation is bad, why isn’t deflation good? Why should we do anything but celebrate if the prices of goods and services fall steadily year after year, and the value of our money rises accordingly? In this post, the first of two parts, I will try to explain just why a majority of economists think deflation is bad. In the second part, I will look at the views of a minority who think that deflation is actually a good thing, at least sometimes.

Delayed consumption—the wrong answer?

Probably the most frequent explanation of the harm done by deflation is that it gives consumers an incentive to delay consumption. A recent article in Salon puts it this way:

When prices fall people stop spending, hoping things will get even cheaper. In response, businesses cut production and lay off workers. That means even less demand, and prices drop further. . . By then, your economy’s in a vicious downward spiral.

This reasoning seems superficially plausible, but it has one big flaw. Although it is true that it pays to delay spending when prices are falling, it can also pay to delay when prices are rising.

Consider an example. You need a new dishwasher, which would cost $500 if you bought it today. You read that the economy is experiencing 2 percent deflation, which suggests that the dishwasher will cost $490 if you wait a year. If you hold your $500 in cash, which may be the best savings vehicle you are can find in a deflationary economy, you will gain $10 by waiting a year

Now think back a few years to when 3 percent inflation was the norm. That would mean your dishwasher would go up in price to $515 if you waited a year, but remember also that back in those days, your bank would probably have offered a 1-year certificate of deposit with an interest rate of something like 5 percent. If you put your $500 in a CD for a year, you’d have $525 when it matured. That means delaying your purchase would give you exactly the same $10 net gain as it would with cash saving and 2 percent deflation.

Σχετικές αναρτήσεις:

- Gros, D. (2014) “Fighting Deflation: Would QE work in the euro area?“, Economic Policy, CEPS Commentaries, 09 Οκτωβρίου.

- Illing, G. (2014) “Should the Euro Area Be Concerned About Deflation?“, INTERECONOMICS, Vol 49, No. 3· Μάιος/ Ιούνιος 2014.

- Anastasatos, T. & Stamatiou, T. (2014) “Is Deflation a Risk for Greece?”, Economy and Markets, Eurobank Research, Vol. IX, Issue 3, Απρίλιος.