Acharya, V. & Steffen, S. (2014) “Benchmarking the European Central Bank’s asset quality review and stress test: A tale of two leverage ratios“, VoxEU Organisation, 21 Νοεμβρίου.

The ECB estimated that Eurozone banks would face a capital shortfall of €25 billion in a severe crisis. Earlier work by the authors estimated the shortfall to be 30 times higher. This column argues that this striking divergence can be explained by the ECB’s reliance on static risk-weights.

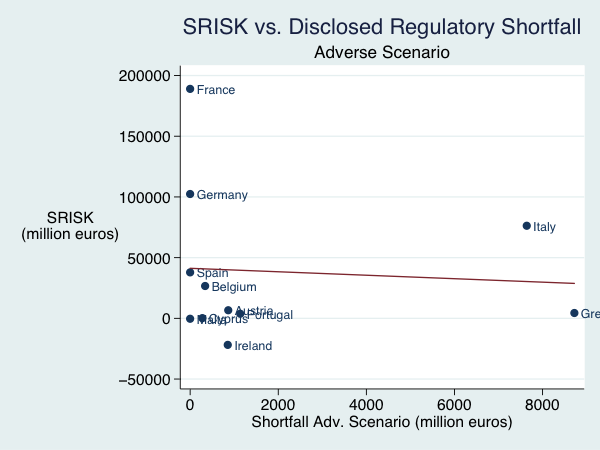

In November 2014, the ECB published its asset quality review (AQR) and comprehensive assessment (ECB 2014), as well as capital shortfall estimates based on its stress test. These results differed widely from our earlier assessment (Acharya and Steffen 2014). Indeed, the two shortfall estimates are negatively correlated.

Calculations that we have recently completed suggest that the divergence between our numbers and those of the ECB can be explained by the continued reliance on static risk-weights in the regulatory assessment. In fact, using the projected losses in the adverse scenario employed by the ECB and applying a different (non risk-weights based, i.e. simple) leverage ratio gives results much closer to ours.

Shortfall measures

We compare two measures of capital shortfall, the “regulatory shortfall measure” as used by the ECB, and SRISK as calculated by NYU Stern School of Business Volatility Lab. Both concepts are conceptually similar as they estimate losses in a stress scenario and determine the capital shortfall between a prudential capital requirement and the remaining equity after losses.

Regulatory shortfall measure: The stress scenario is the adverse scenario as described in ESRB (2014) at the end of 2016. The regulatory benchmark is the Common Equity Tier 1 (CET1) ratio that is defined as CET1 capital divided by risk-weighted assets (RWA). The ECB applies a hurdle rate of 5.5% in the adverse scenario. Note that the CET1/RWA ratio is the only benchmark (or leverage) ratio that has been applied in the comprehensive assessment of the ECB.

Figure 1a SRISK vs. Regulatory shortfall measure

Σχετικές αναρτήσεις:

- Acharya, V. & Steffen, S. (2014) “Making sense of the comprehensive assessment“, VoxEU Organisation, 29 Οκτωβρίου.

- Goodhart, C. & Schoenmaker, D. (2014) “The ECB as lender of last resort?“, VoxEU Organisation, 23 Οκτωβρίου.

- Durden, T. (2014) “The ECB Changes Its Mind Which Bonds It Will Monetize, Then It Changes It Again“, ΘZeroHedge, 20 Οκτωβρίου.