Gilbert, M. (2014) “Europe’s Bonds Are Unyielding“, Bloomberg View–European Economy, 14 Νοεμβρίου.

With central bank interest rates at or near zero in many parts of the world, borrowing costs for governments and companies have plunged to record lows. In Europe, corporate bond yields are now so low that it’s hard to see how fixed-income investors will be able to make money. It’s also difficult to imagine that yet more cheap cash from the European Central Bank will arouse the region’s animal spirits.

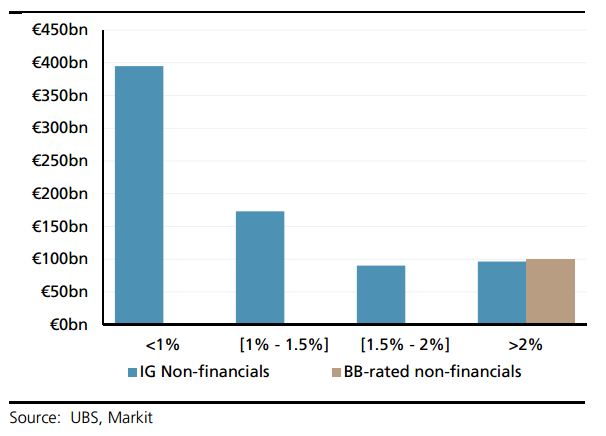

Here’s a chart breaking down the region’s universe of benchmark investment-grade bonds by yield, courtesy of Suki Mann, the head of European credit strategy at UBS in London. Mann’s astonishing conclusion is that more than half of the market currently offers yields of less than 1 percent:

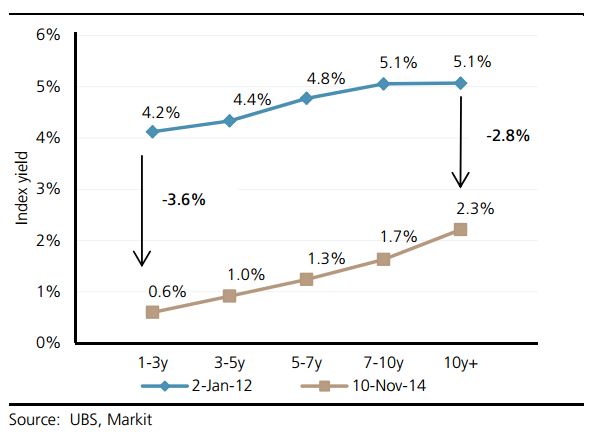

Digging into the data reveals that not only have those yields plunged in the past two years, the potential income from buying bonds repayable in three years or less is even lower:

As yields decline, prices rise, so investors have made money this year; Mann estimates a total return of 7.5 percent. At ever-lower yields, though, the potential to generate profit is diminished…

Σχετικές αναρτήσεις:

- Durden, T. (2014) “The ECB Changes Its Mind Which Bonds It Will Monetize, Then It Changes It Again“, ΘZeroHedge, 20 Οκτωβρίου.

- Gros, D. (2014) “The ECB’s Faulty Weapon“, Project Syndicate, 07 Οκτωβρίου.

- Kirkegaard, F. J. (2014) “ECB Sovereign Bond Purchases Remain Unlikely“, Peterson Institute for International Economics, 01 Οκτωβρίου.