Durden, T. (2014) “The Eurozone’s QE Problem“, ΘZeroHedge, 19 Νοεμβρίου.

Over the last couple of weeks, as the Federal Reserve ended their latest round of quantitative easing, there have been many calls that the pickup of the “QE Baton” by the BOJ and ECB. The problem is that the impact of liquidity interventions in Japan and the Eurozone do not carry the same “punch” as was witnessed in the U.S due to differences in economic underpinnings. Furthermore, while Japan can easily implement QE since they are a sovereign currency issuer, the ECB is not and must rely on the generosity of its members.

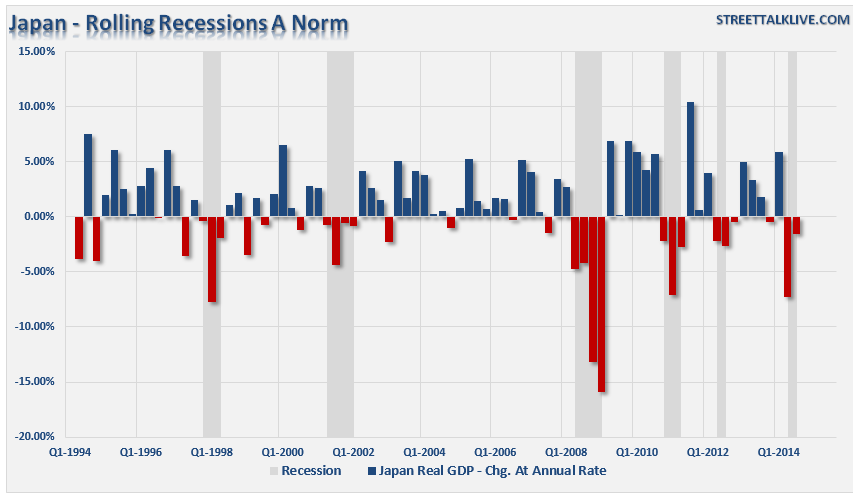

As I wrote this past Monday, Japan has officially slipped into a third economic recession in as many years despite the BOJ’s efforts to stimulate a return of economic prosperity and inflation. This is not a new problem, as Japan has been fighting disinflationary pressures in their country for the last 30 years as shown in the chart below. Japan’s internal struggle with an aging population, lack of savings and accelerating debt/GDP ratios continue to plague economic prosperity.

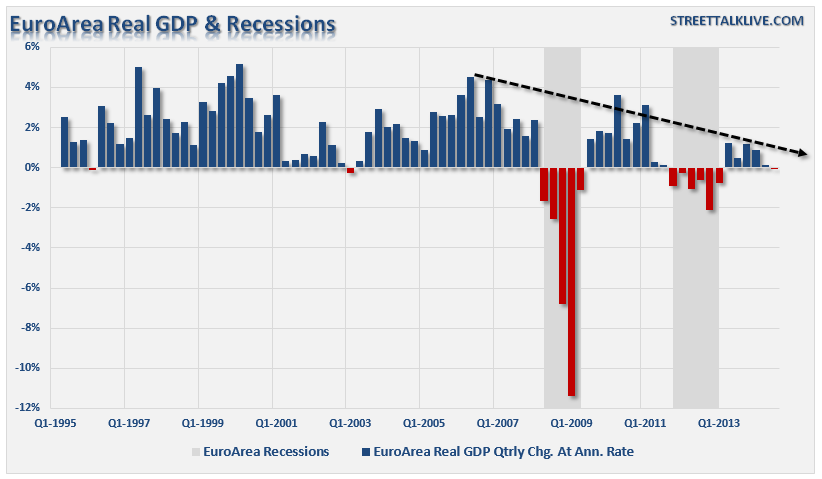

Much like Japan, the Eurozone has also become entangled in same “liquidity trap” as member countries continue to avoid making necessary structural reforms to cure their burdensome debt, dependency and unemployment ratios. As shown, the decline rate in economic growth since 2007 shows the real problem. Despite successive rounds of monetary interventions and suppression of interest rates by the ECB, the Eurozone has only experienced fits and starts of declining economic activity.

Σχετικές αναρτήσεις:

- Wyplosz, C. (2014) “Is the ECB doing QE?“, VoxEU Organisation, 12 Σεπτεμβρίου.

- Magnus, G. (2014) “The ECB and Sisyphus: it won’t be finished unless it does QE“, Pieria Online, 09 Ιουνίου.

- Varoufakis, Y. (2014) “How should the ECB enact Quantitative Easing? A proposal“, Thoughts for the post-2008 World Blog, 19 Μαΐου.