Martin, P. & Philippon, T. (2014) “What caused the great recession in the Eurozone? What could have avoided it?“, VoxEU Organisation, 11 Νοεμβρίου.

Economists disagree over the origin of the Eurozone Crisis. This column uses a quantitative framework to sort through the various channels and policy impacts. It argues that fiscal and macroprudential policies are complements, not substitutes. Prudent fiscal policy is helpful but cannot by itself undo private leverage booms. Both prudent fiscal policies and macroprudential policies are required to stabilise the economy and make the Eurozone a viable monetary union.

There is a wide disagreement about the nature and cause of the Eurozone crisis. Some see it as driven by fiscal indiscipline, some emphasise excessive private leverage, while others focus on external imbalances, sudden stops, or competitiveness divergence due to fixed exchange rates, as these quotes illustrate:

Paul de Grauwe (2012): “The situation of Spain is reminiscent of the situation of emerging economies that have to borrow in a foreign currency…they can suddenly be confronted with a ‘sudden stop’ when capital inflows suddenly stop leading to a liquidity crisis”.

Lorenzo Bini Smaghi (2013): “… countries which lost competitiveness prior to the crisis experienced the lowest growth after the crisis”.

Hans Werner Sinn (2010): “The lesson to be learned from the crisis is that a currency union needs ironclad budget discipline to avert a boom-and-bust cycle in the first place”.

Paul Krugman (2012): “… on the eve of the crisis (Spain) had low debt and a budget surplus. Unfortunately, it also had an enormous housing bubble, a bubble made possible in large part by huge loans from German banks to their Spanish counterparts”.

Most observers understand that all these ‘usual suspects’ have played a role and may be interrelated, but do not offer a way to quantify their respective importance. In this context, it is difficult to frame policy prescriptions on macroeconomic policies and on reforms in the Eurozone.

Given the scale of the crisis, understanding the dynamics of the Eurozone is a major challenge for macroeconomics today. We argue that we need a quantitative framework to identify these various mechanisms, their relations and, ultimately, to run counterfactual experiments. This is what we do in a recent paper (Martin and Philippon 2014).

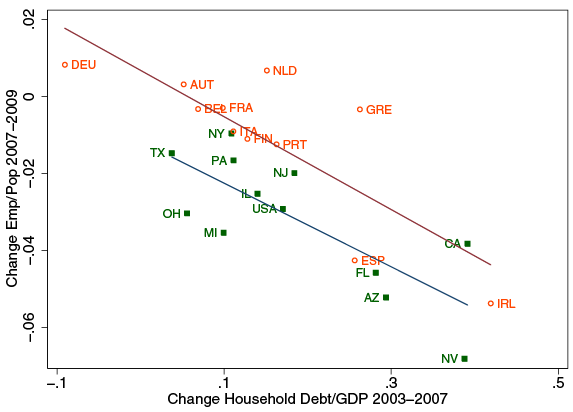

Figure 2. First stage of the Great Recession: Household borrowing predicts employment bust in the US and the Eurozone

Σχετικές αναρτήσεις:

- Wren-Lewis, S. (2014) “Does Politics Dominate Economics In Eurozone Crisis Management?“, Social Europe Journal, 18 Ιουνίου.

- Schadler, S. (2014) “The IMF’s preferred creditor status: Questions after the Eurozone crisis”, VoxEU Organisation, 28 Απριλίου.

- Patel, Α., (2014) “Eurozone Crisis: Another Chapter in the Never-Ending Saga of Boom and Bust“, LSE Eurocrisis in the Press, 21 Φεβρουαρίου.