Gaillard, E. & Straathof, B. (2015) “Will R&D tax incentives get Europe growing again?“, VoxEU Organisation, 20 Ιανουαρίου.

Tax incentives have become a common policy tool for encouraging firms to spend more on research and development – and the recession has further raised interest in the effectiveness of this policy. This column highlights a new review of the empirical evidence, which suggests that fiscal incentives for R&D only modestly stimulate R&D, while their impact on innovation and economic growth is uncertain.

R&D tax incentives have become much more popular in the last two decades. Part of their popularity can be explained by their generic nature – governments can stimulate innovation while firms remain free to choose the R&D projects they invest in. In addition, R&D tax incentives have low administrative costs in comparison to direct subsidies for innovation. These characteristics make R&D tax incentives a form of innovation policy that is unlikely to lead to unintended market distortions.

The economic recession has further raised interest in the effectiveness of these tax incentives, and for two opposing reasons. First, R&D tax incentives are viewed as tools that protect innovative activity at economically challenging times and potentially promote growth. A second, emerging, reason is that large government budget deficits trigger a re-examination of innovation policies associated with large amounts of foregone tax revenue. The tension between promoting growth and reducing deficits has led to a call for ‘smart consolidation’ – growth-enhancing policies should be protected from budget cuts. Veugelers (2014) argued that the evidence on the effectiveness of innovation policies is insufficient to guide ‘smart consolidation’ measures.

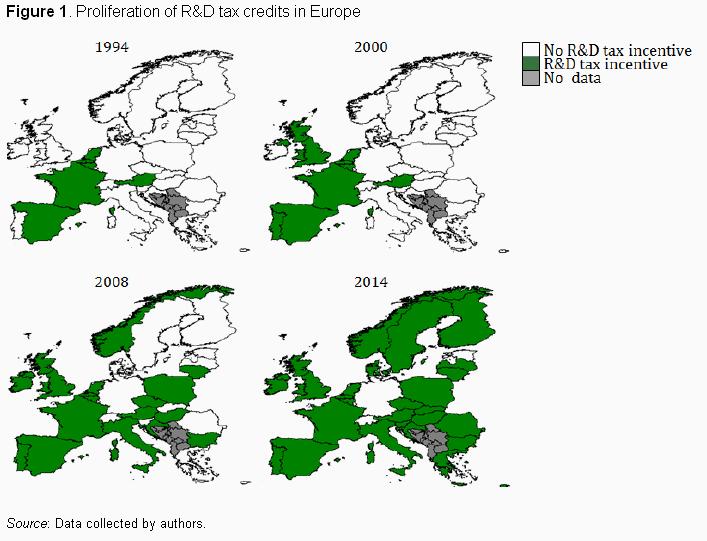

Figure 1 displays the adoption of R&D tax credits in European countries for the period from 1994 to 2014. The figure suggests that, so far, concerns about economic growth have clearly prevailed over concerns about budgetary deficits. Nine European countries have introduced R&D tax incentives since 2008, while no country has discontinued them.

Σχετικές αναρτήσεις:

- European Commission (2014) Researchers’ Report 2014, DG Research and Innovation, Deloitte, Σεπτέμβριος.

- Veugelers, R. (2014) “Is Europe saving away its future? European public funding for research in the era of fiscal consolidation“, VoxEU Organisation, 28 Αυγούστου.

- Veugelers, R. (2014) “Undercutting the future? European research spending in times of fiscal consolidation“, Bruegel Policy Contribution, Issue 2014/6, Ιούνιος.