Eurostat News Release: A new data collection for government finance statistics – First time release of data on contingent liabilities and non-performing loans in EU Member States, 10 Φεβρουαρίου.

Eurostat, the statistical office of the European Union, publishes for the first time today relevant information on contingent liabilities and non-performing loans of government. These data have been provided by the EU Member States in the context of the Enhanced Economic Governance package (the “six pack”).

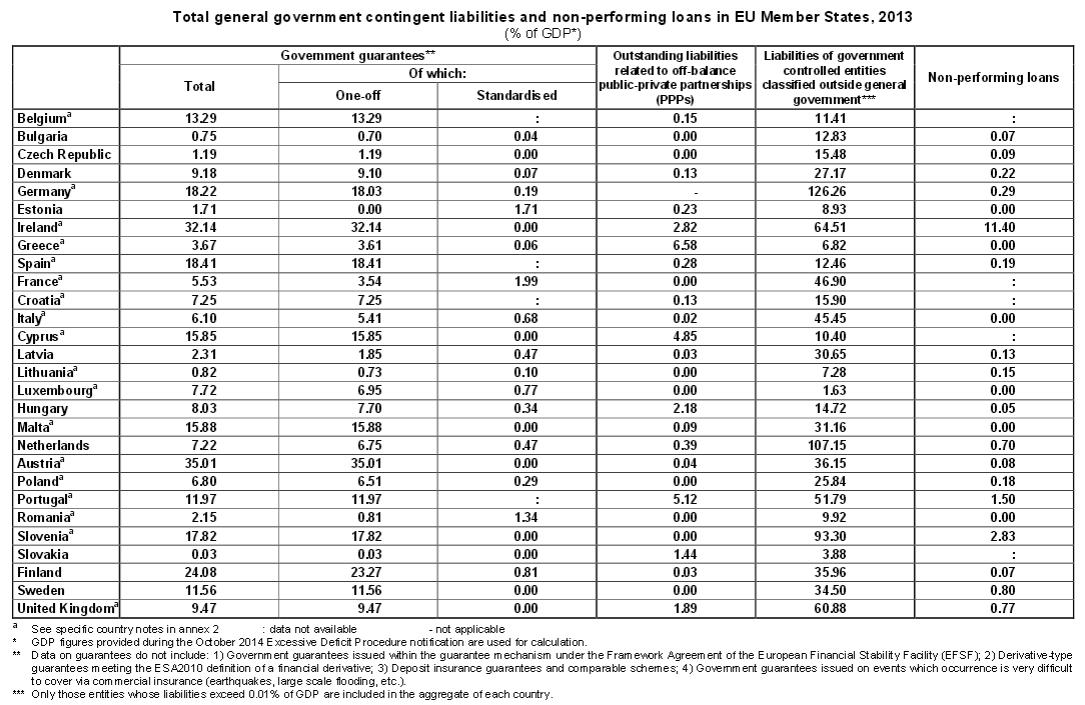

The contingent liabilities published in this release include government guarantees, liabilities related to public-private partnerships recorded off-balance sheet of government and liabilities of government controlled entities classified outside general government (public corporations). The liabilities are called “contingent” in the sense that they are by nature only potential and not actual liabilities. Non-performing loans could imply a potential loss for government if these loans were not repaid. Thus, this new data collection represents a step towards further transparency of public finances in the EU by giving a more comprehensive picture of EU Member States’ financial positions.

Due to their characteristics, data are country specific and closely linked to national particularities regarding the economic, financial and legal structure of the country. Furthermore, data coverage is not complete for all the Member States, as indicated in the attached country footnotes. For these reasons, data presented in this news release should be interpreted with caution. In particular, for the liabilities of public corporations, the data comparability is very limited due to the fact that for some Member States data reported is not exhaustive, in some cases not including the liabilities of financial institutions and/or the liabilities of units controlled by local government.

Several other aspects should be taken into account when analysing the results of the liabilities of public corporations. Firstly, the data reported for liabilities of public corporations are not consolidated, which means that part of the liabilities of these units could be towards entities in the same company group. However, the liabilities between units in the same group are not identifiable from the data reported. Secondly, the data collection only refers to liabilities without balancing them with the assets. This aspect is very important in the case of financial institutions which normally have both significant amounts of liabilities and assets. Additionally, for some of the Member States, most of the liabilities reported by financial institutions concern deposits.

In the following pages, 2013 data on contingent liabilities and non-performing loans are presented, for each EU Member State, expressed as percentage of GDP. Annexes provide descriptions of the indicators and country specific information.