Justiniano, A., Primiceri, G. & Tambalotti, A. (2015) “Credit supply and the housing boom“, VoxEU Organisation, 27 Φεβρουαρίου.

There is no consensus among economists on the forces that drove the historical rise of US house prices and household debt that preceded the Global Crisis. In this column, the authors argue that the fundamental factor behind that boom was an increase in the supply of mortgage credit. This rise was brought about by the diffusion of securitisation and shadow banking, and by a surge in foreign capital inflows. The finding is based on a straightforward interpretation of four key macroeconomic developments between 2000 and 2006, provided by a simple general equilibrium model of housing and credit.

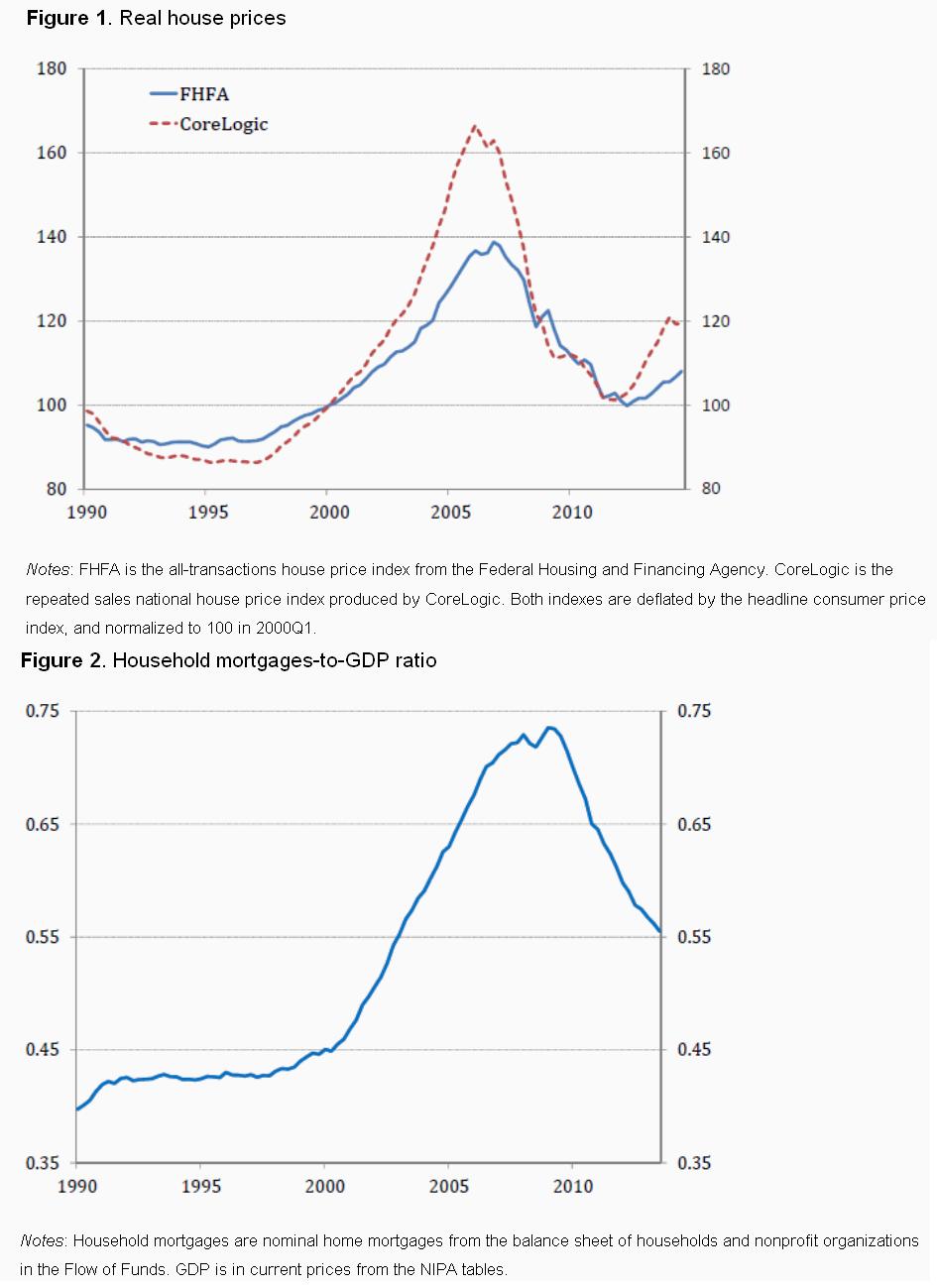

The Global Crisis precipitated the worst US recession since the Great Depression. The spectacular rise in house prices and household debt during the first half of the 2000s, which is illustrated in Figures 1 and 2, was a crucial factor behind these events. Yet, economists disagree on the fundamental causes of this credit and housing boom.

Σχετικές αναρτήσεις:

- Weisbrot, M. (2015) “Greece’s stance against crippling austerity is a fight to save all Europe“, Tribune News Service, 26 Φεβρουαρίου.

- Moring, A. (2015) “Lessons from the crisis – We Europeans face a historic choice: either we further develop Europe as a single political entity, or we recede from the limelight, The European Magazine, 30 Ιανουαρίου.

- Montalvo, J.G. (2014) “Any hope that a revival of Spain’s housing market could help kick-start the country’s economy is likely to prove misplaced“, LSE EUROPP, 06 Νοεμβρίου.