Vives, X. (2015) “A framework for banking structural reform, VoxEU Organisation, 17 Μαρτίου.

The 2007–08 crisis revealed regulatory failures that had allowed the shadow banking system and systemic risk to grow unchecked. This column evaluates recent proposals to reform the banking industry. Although appropriate pricing of risk should make activity restrictions redundant, there may nevertheless be complementarities between these two approaches. Ring-fencing may make banking groups more easily resolvable and therefore lower the cost of imposing market discipline.

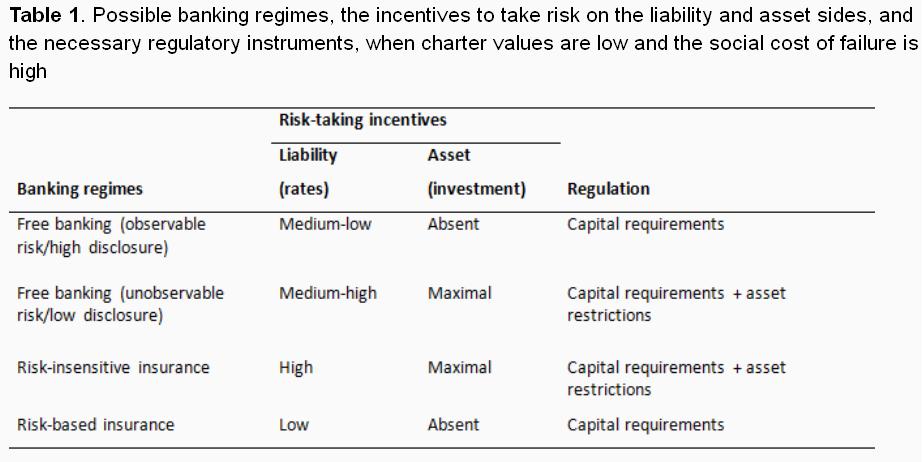

The present crisis has made evident the failure of the three pillars of the Basel II system. Disclosure and risk assessment have been deficient (think for example about the problems with rating agencies), and market discipline has been ineffective because of the blanket insurance offered by ‘too big to fail’ policies. To this a collective moral hazard problem of ‘too many to fail’ may have been added, since when many institutions choose correlated risks, as in the 2007–08 crisis with high direct and indirect exposure to real estate, the central bank and/or the regulator are compelled to bail out failing banks ex post. The incentives to herd are particularly strong for small banks (see Acharya and Yorulmazer 2007, Farhi and Tirole 2012). Furthermore, capital regulation has not taken into account systemic effects (the social cost of failure), and capital requirements have been softened and asset restrictions lifted, likely under the pressure of industry lobbies.1 Supervision has proved ineffective since it allowed a shadow banking system and systemic risk to grow unchecked. In summary, the crisis uncovered massive regulatory failure.

Σχετικές αναρτήσεις:

- Nelson, Β., Pinter, G. & Theodoridis, K. (2015) “Does a surprise tightening of monetary policy expand shadow banking?“, VoxEU Organisation, 16 Μαρτίου.

- Danielsson, J. (2015) “Post-Crisis banking regulation: Evolution of economic thinking as it happened on Vox“, VoxEU Organisation, 02 Μαρτίου.

- STRATFOR (2014) “Europe: Building a Banking Union“, Europe’s Economic Crisis Timeline, 30 Οκτωβρίου.