Fernández, Α., Klein, W. M., Rebucci, A., Schindler, M. & Uribe, M. (2015) “Capital control measures: A new dataset“, VoxEU Organisation, 02 Απριλίου.

A renewed interest in capital controls following the Great Recession requires a serious empirical reconsideration of their effectiveness as policy instruments. This column introduces a new dataset that features unprecedented levels of disaggregation between asset categories, and distinguishes transactions between residents and non-residents. The ensuing debate should take note.

The Great Recession has spurred a reconsideration of the appropriate role of capital controls. The prevailing view among economists in the 1990s was reflected in the title of Rudiger Dornbusch’s 1998 article “Capital Controls: An Idea Whose Time is Gone”.

Attitudes began to shift in response to the economic crises of the late 1990s. More recently, IMF staff studies and policy papers have shown greater acceptance of the use of capital controls as part of a country’s ‘policy toolkit’ under certain circumstances, a shift that The Economist magazine dubbed “The Reformation”.1 Other prominent calls for a greater role for capital controls include those by Jeanne et al (2012) and Rey (2013). Some of these policy prescriptions are consistent with a new branch of theoretical research in which capital controls contribute to financial stability and macroeconomic management.2 But these theoretical works stand in contrast to a large number of empirical analyses that emphasize the ineffectiveness and potential costs of capital controls.3

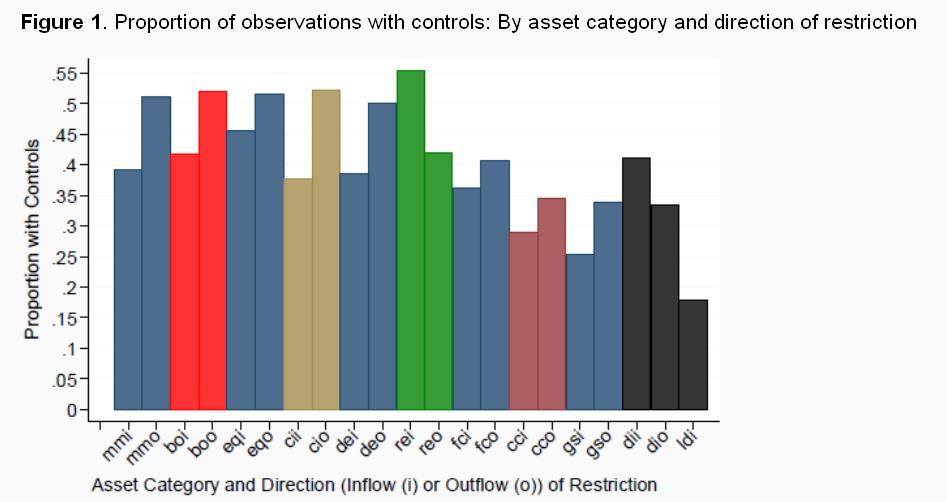

The evolving debate on capital controls highlights the importance of careful empirical analyses of these policies. One challenge facing researchers in this area is the availability of indicators of capital controls. We have constructed a new data set that reports the presence or absence of de jure capital controls, on an annual basis, for 100 countries over the period 1995 to 2013.4 Like other de jure capital control panel data sets, ours is based on information in the IMF’s Annual Report on Exchange Arrangements and Exchange Restrictions (AREAER).5 One contribution of our work is that we have developed a specific set of rules for coding the narrative reports in the AREAER, which we present in a technical appendix to our paper.

Σχετικές αναρτήσεις:

- Davíðsdóttir, S. (2015) “Cyprus and Iceland: a tale of two capital controls“, A Fistful of Euros – European Opinion Blog, 06 Μαρτίου.

- Ghosh, R. A., Qureshi Saeed, M. & Sugawara, N. (2014) “Regulating Capital Flows at Both Ends: Does it Work?“, IMF Publications, Working Paper 14/188, 17 Οκτωβρίου.

- Onado, M., (2014), “European banks: Between a rock (need of more capital) and a hard place (low profitability)”, VoxEU, 23 Φεβρουαρίου.