Daily chart – Payback time, The Economist Graphic Detail: Charts-Maps-Infographics, 14 Απριλίου 2015.

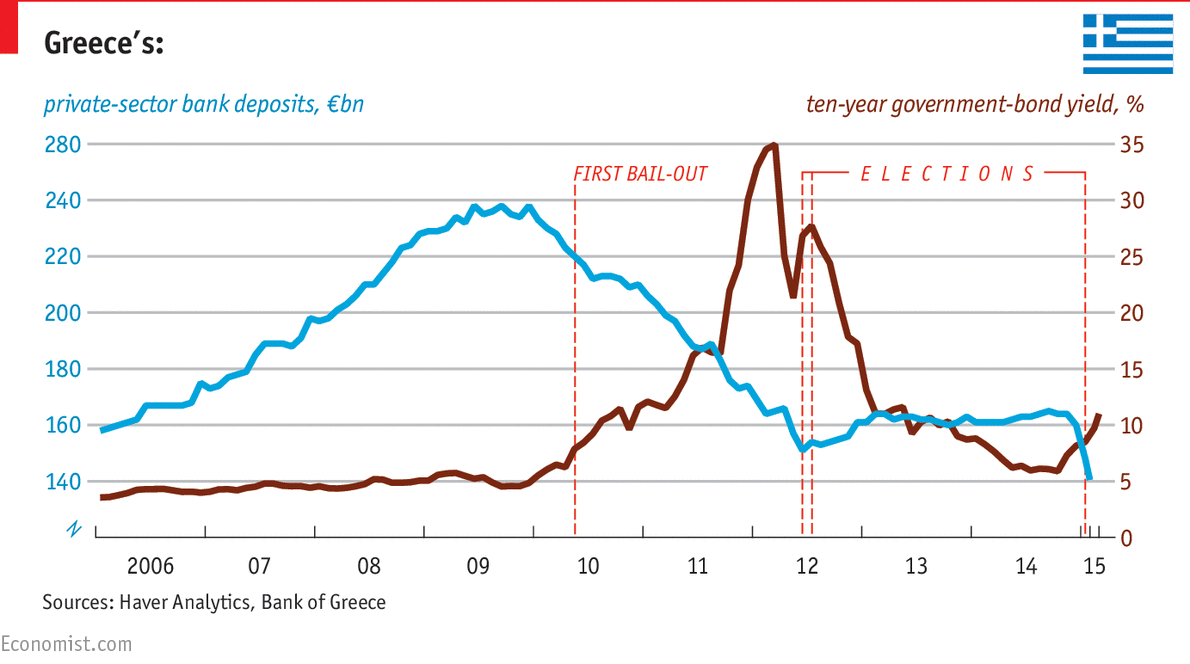

NOT much has gone right for Greece since the Syriza-led government of Alexis Tsipras took power earlier this year. Mr Tsipras’s promise to press Greece’s European creditors for better bail-out terms rattled markets; both bank deposits in Greece and sovereign bond yields, which had been stable under the previous government, have moved in an ominous direction in recent months. Discussions with creditors continue, but each payment date looks a dangerous potential stumbling block. Greece’s government is warning that if it cannot agree a new bail-out deal by the end of April it will miss payments amounting to €2.5 billion due to the International Monetary Fund in May and June.

A weak Greek economy has wobbled amid political uncertainty. Greek banks have been forced to rely on emergency funding from the European Central Bank. Tax revenue dropped ahead of January’s election, and the government’s fiscal position has worsened considerably. Recent data suggest the Greek economy may be slipping back into recession. Meanwhile, big bills are looming. By the terms of the previously agreed deal Greece is owed €7.2 billion, which it needs to pay loans as they come due and to meet domestic obligations. But European leaders have been reluctant to hand over the cash until it is clear that Greece intends to follow through on promised structural reforms.

The exact extent of the government’s financial shortfall remains unclear. Greece’s public-debt burden is almost 180% of GDP. But thanks to the generous terms of its debt, including long maturities and low interest rates, its servicing costs as a share of GDP are actually lower than in many other countries in the euro zone. Yet while Greece has aggressively cut some components of government spending it has done little to tackle its biggest fiscal mess: an extraordinarily generous pension system. The government owes pensioners and civil servants €2.4 billion in April alone, and the it may be forced to choose whether to shortchange its lenders or the Greek people who put it in power. Greece’s repayment schedule may extend beyond 2050, but markets seem more concerned that Greece will not make it to the summer.