The Economist, (2018), “Quantitative easing draws to a close, despite a faltering economy”, The Economist (print edition), 6 Δεκεμβρίου Central banking can be agonising. The effect of monetary policy on the economy is not immediate, so decisions must be based on expectations for two years’ time. That means putting faith in forecasts that could well turn out to be wrong. Some soul-searching might be expected at the monetary-policy meeting of the …Read More

Greece Drags Itself Back Toward Normality

Ferdinando Giugliano, (2018), “Greece Drags Itself Back Toward Normality”, Bloomberg Opinion, 7 Δεκεμβρίου As the cradle of democracy, Greece knows better than most countries what politics is all about. Yet, for the last eight years, any discussions between lawmakers from the left and right there have been overshadowed by the country’s economic collapse, and the string of rescue programs put together by the European Union and International Monetary Fund. Athens has …Read More

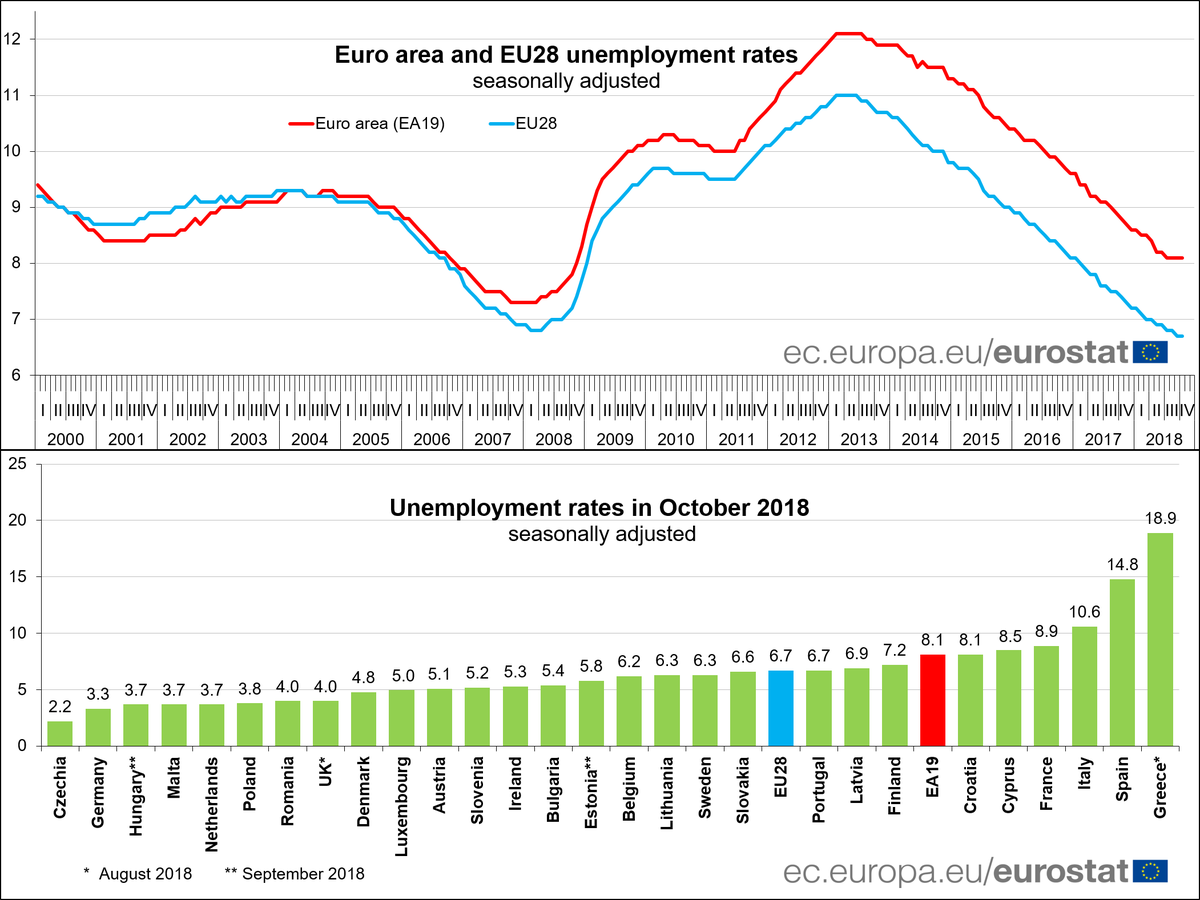

Euro area unemployment at 8.1%

Eurostat/Euro area unemployment at 8.1%/30 Νοεμβρίου 2018 The euro area (EA19) seasonally-adjusted unemployment rate was 8.1% in October 2018, stable compared with September 2018 and down from 8.8% in October 2017. This remains the lowest rate recorded in the euro area since November 2008. The EU28 unemployment rate was 6.7% in October 2018, stable compared with September 2018 and down from 7.4% in October 2017. This remains the lowest rate …Read More

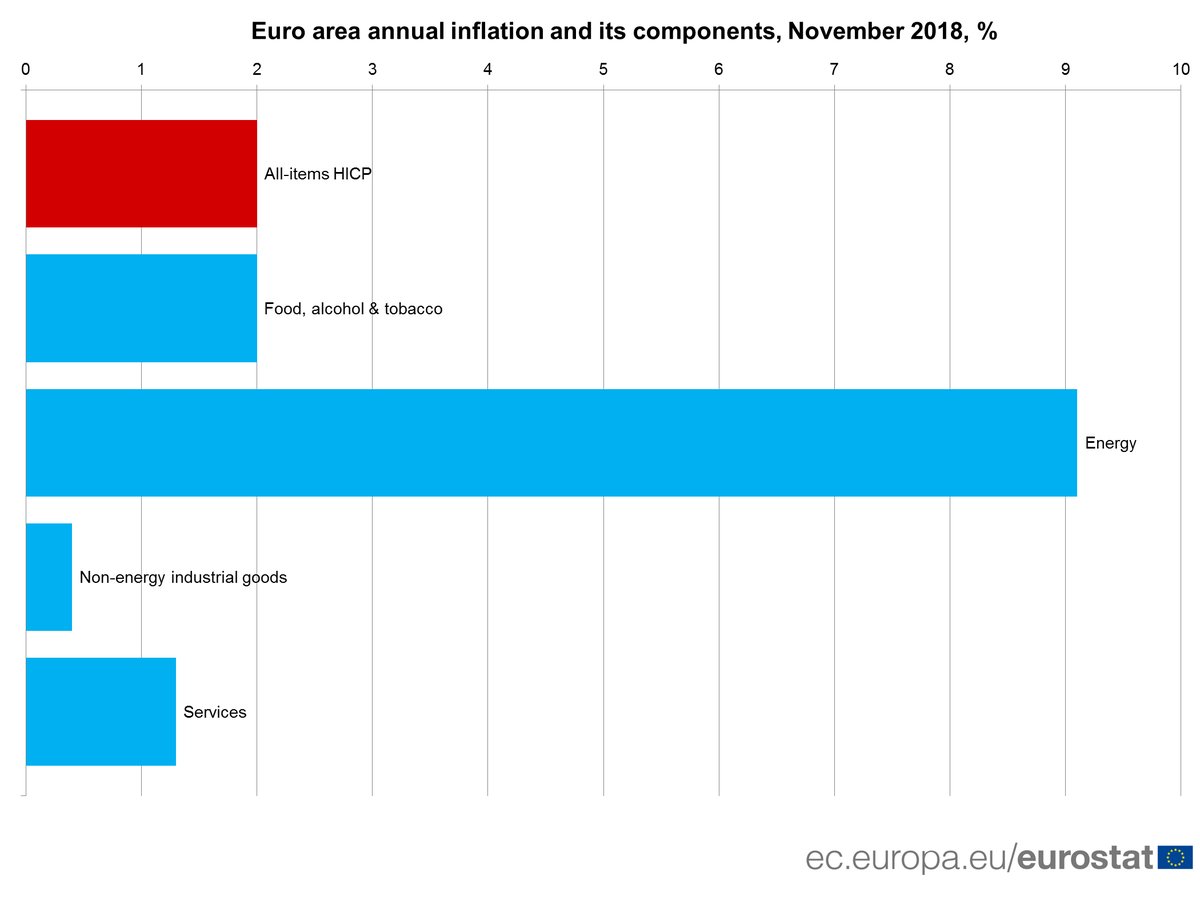

Euro area annual inflation down to 2.0%

Eurostat/Euro area annual inflation down to 2.0%/30 Νοεμβρίου 2018 Euro area annual inflation is expected to be 2.0% in November 2018, down from 2.2% in October 2018, according to a flash estimate from Eurostat, the statistical office of the European Union. Σχετικές Αναρτήσεις Eurostat/Annual inflation up to 2.2% in the euro area/16 Νοεμβρίου 2018 Eurostat/Euro area annual inflation up to 2.2%/31 Οκτωβρίου 2018

The French “Yellow Vest” Movement and the (Current) Failure of Representative Democracy

Olivier Blanchard, “The French “Yellow Vest” Movement and the (Current) Failure of Representative Democracy”, Peterson Institute for International Economics, 3 Δεκεμβρίου Images of gilets jaunes in France—so named for the yellow vests they wear—have flooded news broadcasts in recent weeks. To trace the deep roots of their protests, one has to go back to the end of communism and the failure of central planning as an alternative to the market …Read More

Europe Plays With Fire on Italy Contagion

Ferdinando Giugliano, (2018), “Europe Plays With Fire on Italy Contagion”, Bloomberg Opinion, 5 Δεκεμβρίου Italy’s populist rulers may have been hoping for some market contagion fear to help them win their budget standoff with Brussels, but so far it’s been a dog that didn’t bark. The economic program of the League and Five Star spooked investors in Italian government bonds, but failed to affect any other member state of the monetary union, …Read More

ECB’s huge forecasting errors undermine credibility of current forecasts

Zsolt Darvas, (2018), “ECB’s huge forecasting errors undermine credibility of current forecasts”, Bruegel, 6 Δεκεμβρίου In its latest projections, on September 13th 2018, ECB staff foresaw a core inflation increase to 1.5% on average in 2019 and further to 1.8% on average in 2020 (core inflation does not include volatile items like energy and food). Such forecasts, along with the renewed euro-area economic growth and the fall in the unemployment rate, constituted …Read More

Here comes the next euro crisis

POLITICO, (2018), “Here comes the next euro crisis”, politico.eu, 27 Νοεμβρίου The most worrying thing is that Europe itself is becoming an ever-more salient issue cutting through parties, parliaments and populations. Pro- and anti-EU camps are competing in elections across Europe today. The next crisis will not be sparked by some unpredictable “black swan.” Rather it will be brought about by a self-fulfilling prophecy: Banking systems showing weaknesses, countries losing access to …Read More

A changing economic vote in Western Europe? Long-term vs. short-term forces

Ruth Dassonneville and Michael S. Lewis-Beck, (2018), “A changing economic vote in Western Europe? Long-term vs. short-term forces”, European Political Science Review, 21 Νοεμβρίου, https://doi.org/10.1017/S1755773918000231 Considerable research shows the presence of an economic vote, with governments rewarded or punished by voters, depending on the state of the economy. But how stable is this economic vote? A current argument holds its effect has increased over time, because of weakening long-term social and political forces. …Read More

European Banks With Bad Loans May Get Help From the EU

Alexander Weber and Silla Brush, (2018), “European Banks With Bad Loans May Get Help From the EU”, Bloomberg, 27 Νοεμβρίου Banks from Greece to Italy that are struggling to get rid of a mountain of bad loans may soon get some help from European Union lawmakers. A bill that’s nearing the finish line in Brussels would soften the capital hit banks usually face when they sell non-performing loans at a loss. …Read More