Abbassi, P., Bräuning, F., Fecht, F. & Peydró, J. S. (2015) “Eurozone interbank lending market during the Global and EZ crises“, VoxEU Organisation, 02 April.

The Global Crisis and subsequent sovereign debt crisis in the Eurozone severely distressed wholesale funding markets. This column argues that in the Eurozone, interbank funding conditions tightened particularly for cross-border borrowing. Moreover, during the worst moments of the crisis, the same borrower bank could pay different prices (up to 100 basis points) for identical loans during the same day. Non-standard monetary policy measures help mitigate these liquidity disruptions, with stronger effects in countries under distress.

The Global Crisis that started with the Lehman Brothers failure in September 2008 and intensified, especially in the Eurozone, with the sovereign debt crisis after April 2010 was largely centred on dry-ups in wholesale funding liquidity, in stark contrast to historical systemic crises where the runs were mainly by retail depositors. Importantly, there has been a geographical fragmentation of liquidity in global markets, notably around the sovereign debt crisis, partially unwinding the financial globalisation trend of the last two decades. The main responses to combat these tensions have been central banks’ non-standard monetary policy actions.

However, empirical evidence on wholesale turmoil and the effects of monetary policy remain scarce, mainly due to the relative lack of comprehensive micro-datasets since wholesale transactions are mostly over-the-counter. In this column, we present micro evidence on the impact of financial crises and monetary policy on the supply of wholesale funding liquidity using a detailed loan-level (lender-borrower-level) dataset of interbank lending based on the Eurozone TARGET 2 data.1

Maturity shift: First tightening in term lending, then overnight lending

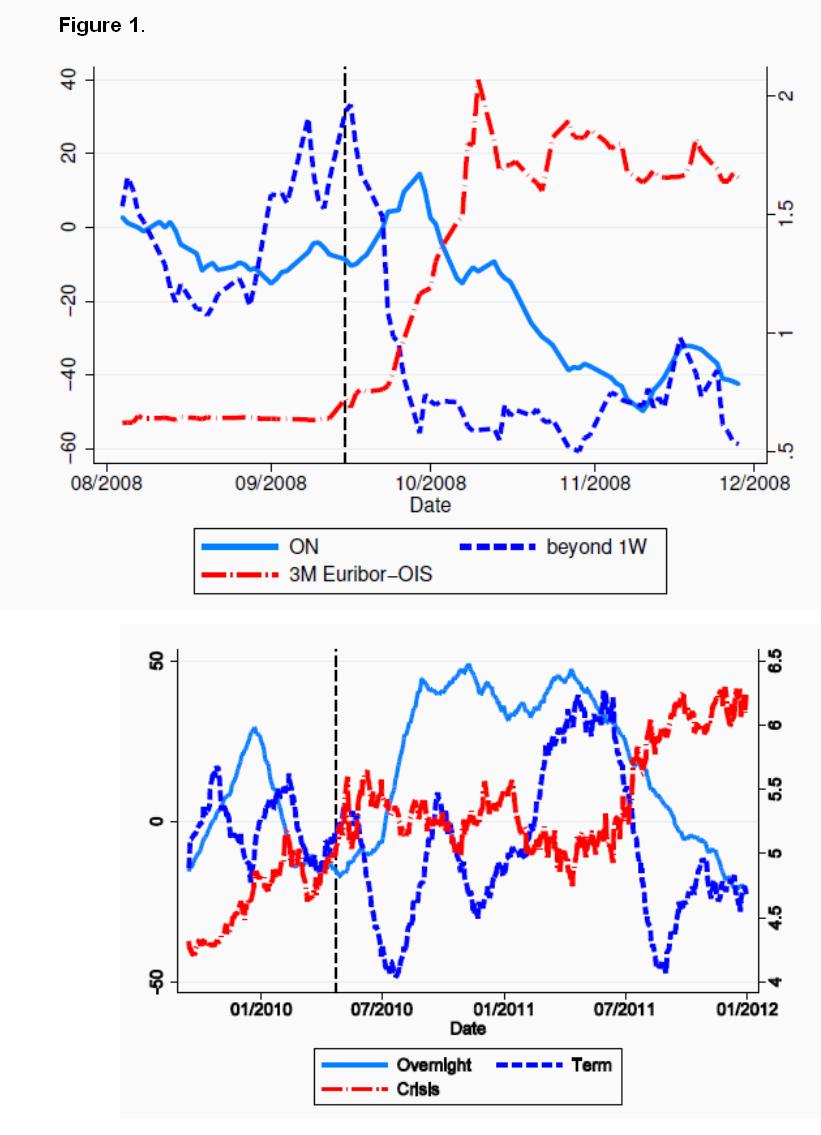

For the Eurozone, we document that in the first two weeks after Lehman’s failure the total turnover in overnight markets actually increased slightly (Figure 1a), i.e. no sign of an imminent liquidity dry-up (Abbassi et al. 2014). However, term-lending volumes decline immediately after Lehman’s collapse by up to 60% as compared to the pre-Lehman level. About two weeks after Lehman, when term-lending volumes discontinue dropping after the massive long-term liquidity freeze, the total overnight lending activity starts decreasing, at a similar degree as observed for term-lending turnover. With the intensification of the sovereign debt crisis, there is a further shift from term-lending to shorter maturities and a stronger tightening for term-credit conditions, which is stronger for borrowers headquartered in countries with sovereign debt problems (Figure 1b).

Relevant posts:

- Vives, X. (2015) “A framework for banking structural reform, VoxEU Organisation, 17 March.

- Nelson, Β., Pinter, G. & Theodoridis, K. (2015) “Does a surprise tightening of monetary policy expand shadow banking?“, VoxEU Organisation, 16 March.

- Danielsson, J. (2015) “Post-Crisis banking regulation: Evolution of economic thinking as it happened on Vox“, VoxEU Organisation, 02 March.