Barry Eichengreen, (2019), “The Return of Fiscal Policy”, Project Syndicate, 13 May Public debt is not a free lunch in an economy close to full employment. But when investment demand tends to fall short of saving, as it does when monetary policymakers are unable to push inflation higher to reduce real interest rates, there is a risk of chronic underemployment – and a stronger argument for deficit spending. Relevant Posts …Read More

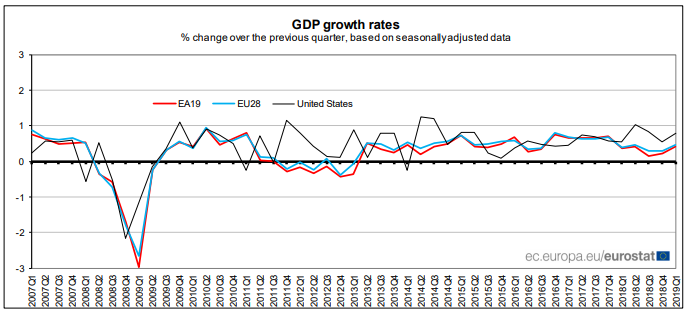

GDP up by 0.4% and employment up by 0.3% in the euro area

Eurostat/GDP up by 0.4% and employment up by 0.3% in the euro area/15 May 2019 Seasonally adjusted GDP rose by 0.4% in the euro area (EA19) and by 0.5% in the EU28 during the first quarter of 2019, compared with the previous quarter, according to a flash estimate published by Eurostat, the statistical office of the European Union. In the fourth quarter of 2018, GDP had grown by 0.2% in …Read More

How to design a stimulus package

Pascal Michaillat and Emmanuel Saez, (2019), “How to design a stimulus package”, VoxEU, 13 May Academics and policymakers alike have debated how to structure an optimal stimulus package since the Great Recession. This column revisits the arguments related to the size of the multiplier and the usefulness of public spending, and offers a blueprint for future stimulus packages. It finds that the relationship between the multiplier and stimulus spending is …Read More

European Parliament elections preview: Greece

Zoe Alipranti, (2019), “European Parliament elections preview: Greece”, LSE EUROPP, 13 May The last European Parliament elections in 2014 took place during a period of significant tension over the Greek debt crisis. As Zoe Alipranti explains, this time around, the European Parliament elections in Greece are unlikely to feature such a high level of polarisation over Europe. Syriza has drifted away from its radical Euroscepticism, and although substantial dissatisfaction persists …Read More

Italy’s incurable economy

Silvia Sciorilli Borrelli, (2019), “Italy’s incurable economy”, Politico, 13 May Ιtaly’s economy is sick and the governing coalition can’t agree on the cure — among themselves or with Brussels. The European Commission said last week that the government’s flagship measures — an early retirement scheme and a citizens’ income (a monthly allowance for certain jobseekers) — failed to trigger the growth the League-5Stars coalition had envisaged. To make matters worse, …Read More

Uncertainty shocks, monetary policy and long-term interest rates

Gianni Amisano and Oreste Tristani, (2019), “Uncertainty shocks, monetary policy and long-term interest rates”, ECB Working Paper Series No 2279, May We study the relationship between monetary policy and long-term rates in a structural, general equilibrium model estimated on both macro and yields data from the United States. Regime shifts in the conditional variance of productivity shocks, or ”uncertainty shocks”, are an important model ingredient. First, they account for countercyclical …Read More

The global economy hit by higher uncertainty

Hites Ahir, Nicholas Bloom and Davide Furceri, (2019), “The global economy hit by higher uncertainty”, VoxEU, 11 May According to the latest IMF projections, the global economy is now projected to grow at 3.3% in 2019, down from 3.6% in 2018. This is partly due to rising uncertainty in many parts of the world. This column shows how these statements are in line with the latest reading of the World …Read More

Don’t Fear the Euroskeptics

Gros, Daniel (2019), “Don’t Fear the Euroskeptics“, Project-Syndicate. org, Μάιος Although the European Union is arguably as popular as ever, the next European Parliament may well contain a large minority of forces skeptical or hostile to further integration. Instead of viewing this as a threat, pro-Europeans should seize the opportunity to start a necessary debate about the continent’s future. Σχετικές Αναρτήσεις Karl Aiginger, (2019), «Populism: Roots, consequences, and counter strategy», 20 …Read More

How stress tests fail

Bulow, Jeremy (2019), “How stress tests fail“, VOX Centre for Economic Policy Research, May Bank stress tests in the US were an important tool for bailing out banks in the Great Recession. As this column points out, however, because the tests use regulatory rather than market measures of asset values and risk they have almost nothing to do with whether a bank will be economically solvent under test conditions. This …Read More

How stress tests fail

Bulow, Jeremy (2019), “How stress tests fail“, VOX Centre for Economic Policy Research, May Bank stress tests in the US were an important tool for bailing out banks in the Great Recession. As this column points out, however, because the tests use regulatory rather than market measures of asset values and risk they have almost nothing to do with whether a bank will be economically solvent under test conditions. This …Read More