Joseph E. Stiglitz, (2018), “Post-Davos Depression”, Project Syndicate, 1 February The CEOs of Davos were euphoric this year about the return to growth, strong profits, and soaring executive compensation. Economists reminded them that this growth is not sustainable, and has never been inclusive; but in a world where greed is always good, such arguments have little impact. Relevant Posts Tingyun Chen, Jean-Jacques Hallaert, Alexander Pitt, Haonan Qu, Maximilien Queyranne, Alaina …Read More

Crisis Management in Greece

Giannitsis, Tassos and Zografakis Stavros, (2018), ” Crisis Management in Greece”, Macroeconomic Policy Institute, Study No. 58, January The aim of this study is to explore the impact of the crisis and crisis-induced policies on incomes, inequality and poverty in Greece, to detect the types of adjustment and to show why prevailing perceptions and attitudes caused a heavy economic, social and political cost. Based on extensive income and tax data …Read More

Why A Rebooted ESM Is Much Better Than An EMF

Marcello Minenna, (2018), “Why A Rebooted ESM Is Much Better Than An EMF“, Social Europe, 1 February After the controversial European Monetary Fund (EMF) proposal by the European Commission of December 2017, it’s clear that the debate about the future role and structure of the European Stability Mechanism is not over. It will only end when the Euro area benefits from a unified government bond market with a single risk-free …Read More

Berlusconi May Be Closer to a Majority in Italy Than Polls Show

Marco Bertacche and Chiara Albanese, (2018), “Berlusconi May Be Closer to a Majority in Italy Than Polls Show”, Bloomberg Politics, 5 Φεβρουαρίου Polls may be downplaying the chances that a center-right coalition backed by former Premier Silvio Berlusconi will win a majority in upcoming Italian elections on March 4. The so-called “shy-factor” in the polling process, which underestimates voting intentions for right-wing parties, and a new electoral law that favors …Read More

Monetary policy with negative nominal interest rates

Gauti Eggertsson, Ragnar Juelsrud, Ella Getz Wold, (2018), “Monetary policy with negative nominal interest rates”, Vox, 31 January Economists disagree on the macroeconomic role of negative interest rates. This column describes how, due to an apparent zero lower bound on deposit rates, negative policy rates have so far had very limited impact on the deposit rates faced by households and firms, and this lower bound on the deposit rate seems …Read More

Disagreement about Future Inflation: Understanding the Benefits of Inflation Targeting and Transparency

Steve Brito, Yan Carriere-Swallow, Bertrand Gruss, (2018), “Disagreement about Future Inflation: Understanding the Benefits of Inflation Targeting and Transparency”, IMF Working Papers, 25 January We estimate the determinants of disagreement about future inflation in a large and diverse sample of countries, focusing on the role of monetary policy frameworks. We offer novel insights that allow us to reconcile mixed findings in the literature on the benefits of inflation targeting regimes and central …Read More

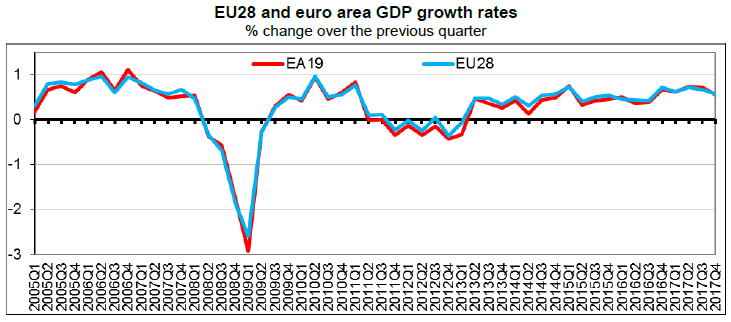

GDP up by 0.6% in both the euro area and the EU28

Eurostat/GDP up by 0.6% in both the euro area and the EU28/30 January 2018 Seasonally adjusted GDP rose by 0.6% in both the euro area (EA19) and in the EU28 during the fourth quarter of 2017, compared with the previous quarter, according to a preliminary flash estimate published by Eurostat, the statistical office of the European Union. In the third quarter of 2017, GDP had grown by 0.7% in both zones. Compared with the …Read More

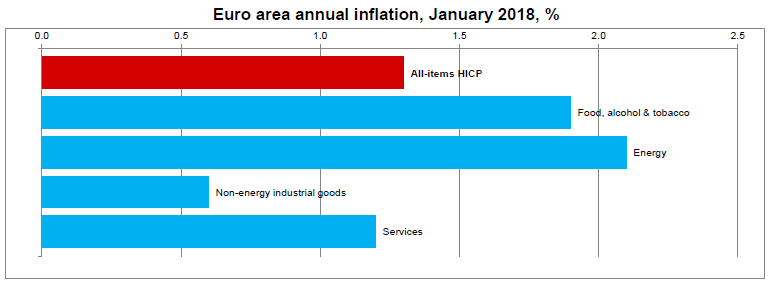

Euro area annual inflation down to 1.3%

Eurostat/Euro area annual inflation down to 1.3%/31 January 2018 Euro area annual inflation is expected to be 1.3% in January 2018, down from 1.4% in December 2017, according to a flash estimate from Eurostat, the statistical office of the European Union. Looking at the main components of euro area inflation, energy is expected to have the highest annual rate in January (2.1%, compared with 2.9% in December), followed by food, alcohol & tobacco …Read More

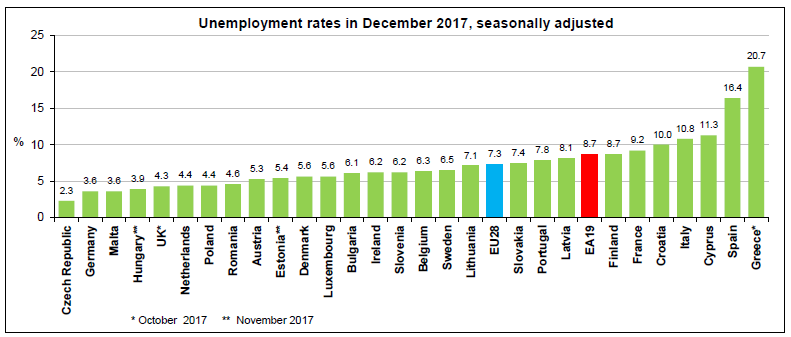

Euro area unemployment at 8.7%

Eurostat/Euro area unemployment at 8.7%/31 January 2018 The euro area (EA19) seasonally-adjusted unemployment rate was 8.7% in December 2017, stable compared to November 2017 and down from 9.7% in December 2016. This remains the lowest rate recorded in the euro area since January 2009. The EU28 unemployment rate was 7.3% in December 2017, stable compared to November 2017 and down from 8.2% in December 2016. This remains the lowest rate …Read More

Banking crisis, bail-ins and money holdings

Martin Brown, Ioanna S Evangelou and Helmut Stix, (2018), “Banking crisis, bail-ins and money holdings”, VoxEU, 1 February A cornerstone of new bank resolution policies across the world is the introduction of bail-ins to redistribute the costs of bank failures from taxpayers to bank creditors. This column uses the bail-in of two banks in Cyprus to examine how bank depositors react to this way of resolving a crisis. In the …Read More