Wendy Carlin, David Soskice,(2018), “The macroeconomic performance paradox: A new model”, Vox, 23 January Following the post-financial crisis recession, standard macroeconomic models would have predicted either a destabilising deflationary spiral, or a return to the central bank’s inflation target with a positive ‘neutral’ real interest rate, along with a rebound of productivity growth, falling unemployment, and rising inflation. Relevant Posts Francesco Papadia, (2018), «Macroprudential policy: The Maginot line of financial stability«, …Read More

Macroprudential policy: The Maginot line of financial stability

Francesco Papadia, (2018), “Macroprudential policy: The Maginot line of financial stability“, Bruegel, 17 January The ability of macroprudential policies to assure financial stability and thus leave central banks free to assign the interest rate tool exclusively to price stability is unproven. As the Maginot line did not protect France from a German invasion in WWII, so macroprudential policy may not be sufficient to counter financial instability. Central banks should prepare …Read More

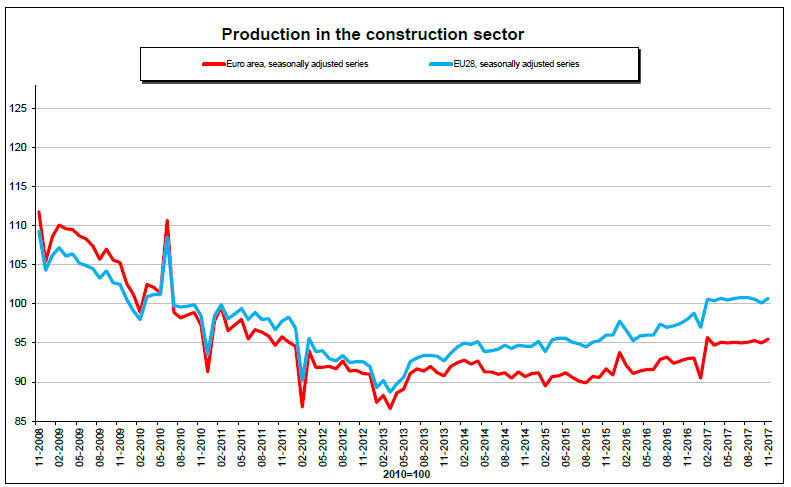

Production in construction up by 0.5% in euro area

Eurostat/Production in construction up by 0.5% in euro area/17 January 2018 In November 2017 compared with October 2017, seasonally adjusted production in the construction sector increased by 0.5% in the euro area (EA19) and by 0.6% in the EU28, according to first estimates from Eurostat, the statistical office of the European Union. In October 2017, production in construction fell by 0.3% in the euro area and by 0.5% in the EU28. Relevant Posts …Read More

How to reconcile risk sharing and market discipline in the euro area

Agnès Bénassy-Quéré, Markus K Brunnermeier, Henrik Enderlein, Emmanuel Farhi, Marcel Fratzscher, Clemens Fuest, Pierre-Olivier Gourinchas, Philippe Martin, Jean Pisani-Ferry, Hélène Rey, Isabel Schnabel, Nicolas Véron, Beatrice Weder di Mauro, Jeromin Zettelmeyer, (2018), “How to reconcile risk sharing and market discipline in the euro area”, Vox, 17 Ιανουαρίου The euro area continues to suffer from critical weaknesses that are the result of a poorly designed fiscal and financial architecture, but its members …Read More

GDP Should Be Corrected, Not Replaced

Urs Rohner, (2018), “GDP Should Be Corrected, Not Replaced”, Project Syndicate, 17 January The hazards of relying solely on gross domestic product as a measure of overall economic activity have become obvious over time, especially as corporate profits have outpaced GDP growth in key economies. But none of the flaws in GDP are fatal, and policymakers should focus on fixing them, rather than seeking an entirely new framework. Relevant Posts …Read More

Analysis of development in EU capital flows in the global context

Grégory Claeys, Maria Demertzis, Konstantinos Efstathiou, Inês Gonçalves Raposo, Pia Hüttl, Alexander Lehmann, (2018), “Analysis of development in EU capital flows in the global context”, Bruegel, 15 January The aim of this report is to analyse capital movements in the European Union in a global context. The monitoring and analysis of capital movements is essential for policymakers, given that capital flows can have welfare implications. Free movement of capital can enhance welfare …Read More

Long-term unemployed youth: Characteristics and policy responses

Mascherini, Massimiliano, Ledermaier, Stefanie Vacas‑Soriano, Carlos Jacobs Lena, (2017), “Long-term unemployed youth: Characteristics and policy responses”, Eurofound, 14 December While the youth labour market has improved considerably since 2014, one legacy of the recent economic crisis is the large cohort of long-term unemployed young people, which represents nearly one-third of jobless young people. This report provides an updated profile of the youth labour market in 2016 and describes trends over the past decade. It …Read More

Climate change adds to risk for banks, but EU lending proposals will do more harm than good

Arnoud Boot, Dirk Schhoenmaker, (2018), “Climate change adds to risk for banks, but EU lending proposals will do more harm than good”, Bruegel, 16 January Climate change is a relevant risk factor for the banking sector, but the European Commission’s plan to lower capital requirements for greener investments is irresponsible in encouraging banks to forego proper risk management. Relevant Posts Canton, Erik, Solera, Irune, (2016), «Greenfield Foreign Direct Investment and Structural Reforms …Read More

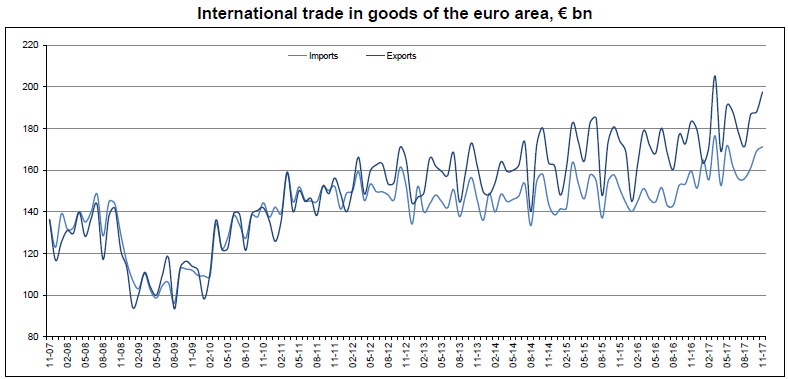

Euro area international trade in goods surplus €26.3 bn

Eurostat/Euro area international trade in goods surplus €26.3 bn/15 January 2018 The first estimate for euro area (EA19) exports of goods to the rest of the world in November 2017 was €197.5 billion, an increase of 7.7% compared with November 2016 (€183.5 bn). Imports from the rest of the world stood at €171.2 bn, a rise of 7.3% compared with November 2016 (€159.6 bn). As a result, the euro area recorded a €26.3 bn …Read More

Does the European Parliament miss an opportunity to reform after Brexit?

Rober Kalcik, Nicolas Moes and Guntram B. Wolff, (2018), “Does the European Parliament miss an opportunity to reform after Brexit?”, Bruegel, 10 January While Brexit negotiations are beginning to progress, the European Parliament is preparing to vote on the possible reallocation of seats following the UK’s departure. With many of the current proposals reflecting Member States’ concerns about losing seats, this paper advocates for options that could better achieve equality …Read More