Henriksen, E., Kydland, F. and Šustek, R., (2013), “Independent monetary policies, synchronised outcomes”, VoxEU, 02 October. The monetary policy for Eurozone members is one-size-fits-all in an economic area rife with economic differences. Does this really make a difference? This column argues that even if each EZ member state had a fully independent monetary authority, monetary policies would likely still appear highly synchronised across EZ members. Relevant Posts Fernandes, S. …Read More

Effects of fiscal consolidation envisaged in the 2013 Stability and Convergence Programmes on public debt dynamics in EU Member States

Berti, K., de Castro, F. and Salto, M., (2013), “Effects of fiscal consolidation envisaged in the 2013 Stability and Convergence Programmes on public debt dynamics in EU Member States”, European Commission, Economic Paper 504, September. This paper presents a simple analysis of the public debt-to-GDP ratio responses to fiscal consolidation efforts envisaged in the 2013 Stability and Convergence Programmes presented by EU Member States. In this paper we assess the …Read More

Tax-policy procyclicality

Vegh, C. and Vuletin, G., (2013), “Tax-policy procyclicality”, VoxEU, 01 October. Government spending is procyclical in developing countries, exacerbating the business cycle. However, an analysis of tax policy is also required in order to properly assess the overall stance of fiscal policy. This column presents recent research showing that tax policy tends to be procyclical in developing countries and acyclical in developed countries. Although some developing countries have managed to …Read More

The Eurozone’s Calm before the Storm

Roubini, N., (2013), “The Eurozone’s Calm before the Storm”, Project Syndicate, 30 September. A little more than a year ago, in the summer of 2012, the eurozone, faced with growing fears of a Greek exit and unsustainably high borrowing costs for Italy and Spain, appeared to be on the brink of collapse. Today, the risk that the monetary union could disintegrate has diminished significantly – but the factors that fueled …Read More

Tax incidence in the presence of tax evasion

Kopczuk, W., Marion, J., Muehlegger, E. and Slemrod, J., (2013), “Tax incidence in the presence of tax evasion”, VoxEU, 30 September. Tax evasion and noncompliance reduces government revenue and exacerbates the problem of increasing debt. Standard economic theory predicts that the identity of the tax remitter shouldn’t affect outcomes – but this ignores the possibility of evasion. This column provides evidence that in the presence of evasion, both the amount …Read More

Germany as Currency Manipulator

Krugman, P., (2013), “Germany as Currency Manipulator”, The New York Times, The Conscience of a Liberal Blog, 27 September. […] The general point is that if we imagine a euro breakup, I think everyone would agree that the new mark would soar in value, making German manufacturing much less competitive. The German public imagines that it is being cruelly exploited for the benefit of lazy southerners; arguably, what’s really happening …Read More

As good as it gets in Latvia?

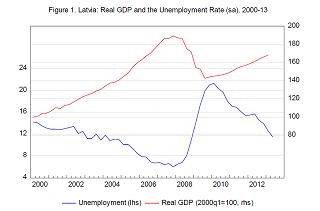

Hugh, E., (2013), “As good as it gets in Latvia?”, Fistfulofeuros Blog, 29 September. “This raises a final question, which, while not central to the issues of this paper, is nevertheless intriguing: How can a country with a low minimum wage, weak unions, limited unemployment insurance and employment protection, have such a high natural rate [of unemployment]?” “To summarize, the actual unemployment rate is still probably higher than, but close …Read More

Notes on Internal Devaluation

Lizoain, D., (2013), “Notes on Internal Devaluation”, Social Europe Journal, 27 September. The Spanish government’s formula for exiting the crisis is called an internal devaluation. This is a euphemism. They are attempting a generalized reduction in wages that requires a weakening of collective bargaining. For this reason, it is worthwhile to explore the concept of internal devaluation in more detail. The theory and the historical evidence is profoundly weak. In …Read More

Dealing with High Debt in an Era of Low Growth

Ali Abas, S.M., Akitoby, B., Andritzky, J.R., Berger, H., Komatsuzaki, T. and Tyson, J., (2013), “Dealing with High Debt in an Era of Low Growth”, IMF Staff Discussion Note, SDN/13/07, September. Τask has become particularly challenging in European advanced economies where expectations of low growth and limits to monetary policy support are shifting the burden of adjustment onto fiscal consolidation. The SDN will investigate the main drivers behind successful past …Read More

The Sovereign Debt Crisis: Placing a curb on growth

Brender, A., Pisani, F. and Gagna, E., (2013), The Sovereign Debt Crisis: Placing a curb on growth, Brussells: Centre for European Policy Studies (CEPS). This book provides an update to the major 2012 study by the same authors on the dual role of the public sector as the provider of the ultimate riskless asset and, at the same time, the source of a potential major systemic risk. In this second …Read More