Scholtens, B. (2015) “Falling oil prices should help Europe’s ailing economies, but the wider implications of the price drop remain to be seen“, LSE EUROPP, 21 Ιανουαρίου.

How will the drop in oil prices affect European economies? As Bert Scholtens writes, the general expectation is that a fall in oil prices should help economic growth across Europe, but there are nevertheless a number of key factors which play an important role in how the price feeds into individual economies. It is also unclear what impact the oil price will have in other areas, such as attempts to transition to renewable energy.

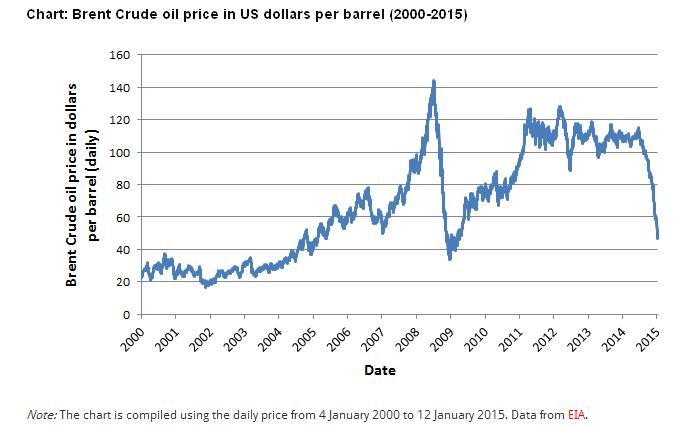

Oil prices have imploded. During the last six months, prices have fallen by more than 60 per cent. One rule of thumb which has been suggested by economists is that an increase in oil prices of $20 per barrel will result in GDP growth within a given country being reduced by 0.25 per cent in the first year and 1 per cent after three years (depending on individual circumstances). For the sake of convenience, the impact of an oil price reduction could be assumed to be the opposite. Many analysts are therefore quite optimistic about the effect on the economies of most European countries.

Several economists are even more optimistic about the impact of the drop in oil prices because of its impact on inflation. As it reduces inflation expectations, it will be more likely that the European Central Bank will intervene, which would support the stock market boom that has already started. Hence, the future seems bright for most of us, with the exception of the oil firms who will see lower revenues. Pessimists warn, however, that this might fuel another asset price bubble which could do enormous damage to European economies now that governments have almost completely run out of mechanisms for dealing with the prolonged economic crisis.

Assessing the effect of the oil price on European economies

There are nevertheless some important factors to take on board before subscribing to this analysis. First, it is important to determine what is driving the oil price change. Here, three aspects need to be accounted for. As an initial point, it should be noted that there is a difference between the physical and the virtual trade in oil contracts. On the physical market, the oil producers sell their oil to refineries who then process the oil. This contrasts with the ‘paper’ market, which deals in contracts to deliver oil on a particular future date. The most important contracts are the West Texas Intermediate (WTI), traded at the New York Mercantile Exchange, and North Sea oil (Brent), traded at ICE Futures in London. The ‘oil price’ is actually the price of the futures contract to deliver oil one month from now.

Σχετικές αναρτήσεις:

- World Economic Outlook Update, International Monetary Fund, Ιανουάριος 2015.

- Mitchell, B. (2015) “Friday lay day – more snake oil from Brussels“, Bill Mitchell Blog, 16 Ιανουαρίου.

- Frankel, J. (2014) “Why so many commodity prices are down in the US, yet up in Europe“, VoxEU Organisation, 24 Δεκεμβρίου.