EuroParl/IPOL/Non-performing loans in the Banking Union: stocktaking and challenges/18 March 2016

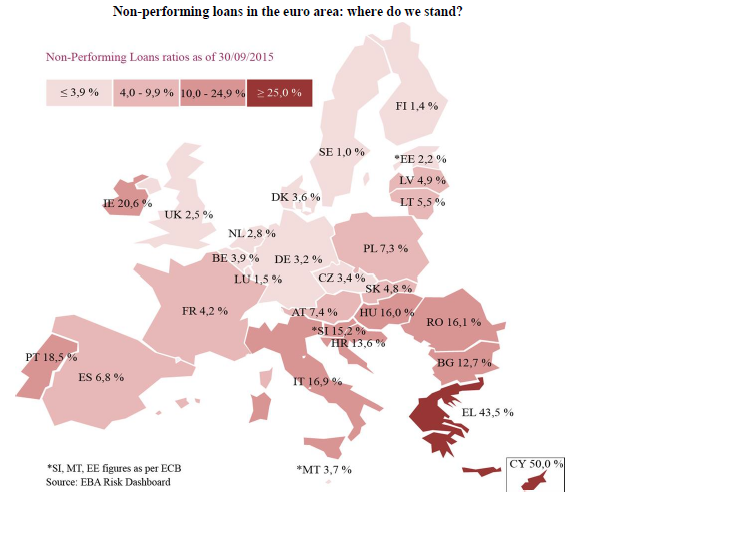

This briefing presents the state of play of non-performing loans (NPL) in the euro area, and provides an overview of the various measures implemented across Member States to facilitate their resolution. The first section briefly presents the various levels of NPL ratios and coverage ratios in the euro area, across Member States, sectors, and groups of banks. The second section explains the detrimental impact of NPL on growth. The remaining sections present the various kinds of measures implemented across Member states to address the issue of non-performing loans: transferring NPL to dedicated bad banks, developing a secondary market for NPL, strengthening insolvency frameworks, as well as enhancing supervision and amending tax rules.

Σχετικές αναρτήσεις

- Berger, Bennet, (2015), “Non-performing loans in Italy and selected European countries”, Bruegel publications, 18 Δεκεμβρίου

- Eurostat News Release: A new data collection for government finance statistics – First time release of data on contingent liabilities and non-performing loans in EU Member States, 10 Φεβρουαρίου.