Aude Bicquelet-Lock, Helen J. Addison, (2018), “Are discretionary referendums on the EU becoming ‘politically obligatory?’”, LSE, EUROPP, 15 May European governments have increasingly held referendums to decide matters associated with the EU since the first one was held in France in 1972, even though all EU states have representative democratic institutions and referendums entail considerable risk of defeat. This surge in non-obligatory referendum pledges inspired some scholars to suggest that referendums …Read More

The Dynamics of Sovereign Debt Crises and Bailouts

Francisco Roch, Harald Uhlig, (2018), “The Dynamics of Sovereign Debt Crises and Bailouts”, CEPR, discussion paper, May Motivated by the recent European debt crisis, this paper investigates the scope for a bailout guarantee in a sovereign debt crisis. Defaults may arise from negative income shocks, government impatience or a “sunspot”-coordinated buyers strike. We introduce a bailout agency, and characterize the strategy with the minimal actuarially fair intervention which guarantees the …Read More

Bye bye parents: when do young Europeans flee the nest?

Eurostat, (2018), “Bye bye parents: when do young Europeans flee the nest?”, 15 May In the European Union (EU), over one young adult out of four (28.5%) aged 25 to 34 were still living with their parents in 2016. Across the EU, this share ranged from less than 10% in the Nordic Member States – Denmark (3.8%), Finland (4.3%) and Sweden (6.0%) – to about half in Croatia (58.7%), Slovakia …Read More

Germany’s current account surplus and corporate investment

Guntram Wolff, (2018), “Germany’s current account surplus and corporate investment”, Bruegel, 9 May Germany’s current account surplus is unusually, and persistently, large. It was above €250 billion euros in 2017, the third consecutive year with a current account surplus above 7.8% of GDP (IMF 2017). To put this into context, of the 193 countries listed in the IMF’s World Economic Outlook between 1999 and 2017 (totalling some 3,570 available observations …Read More

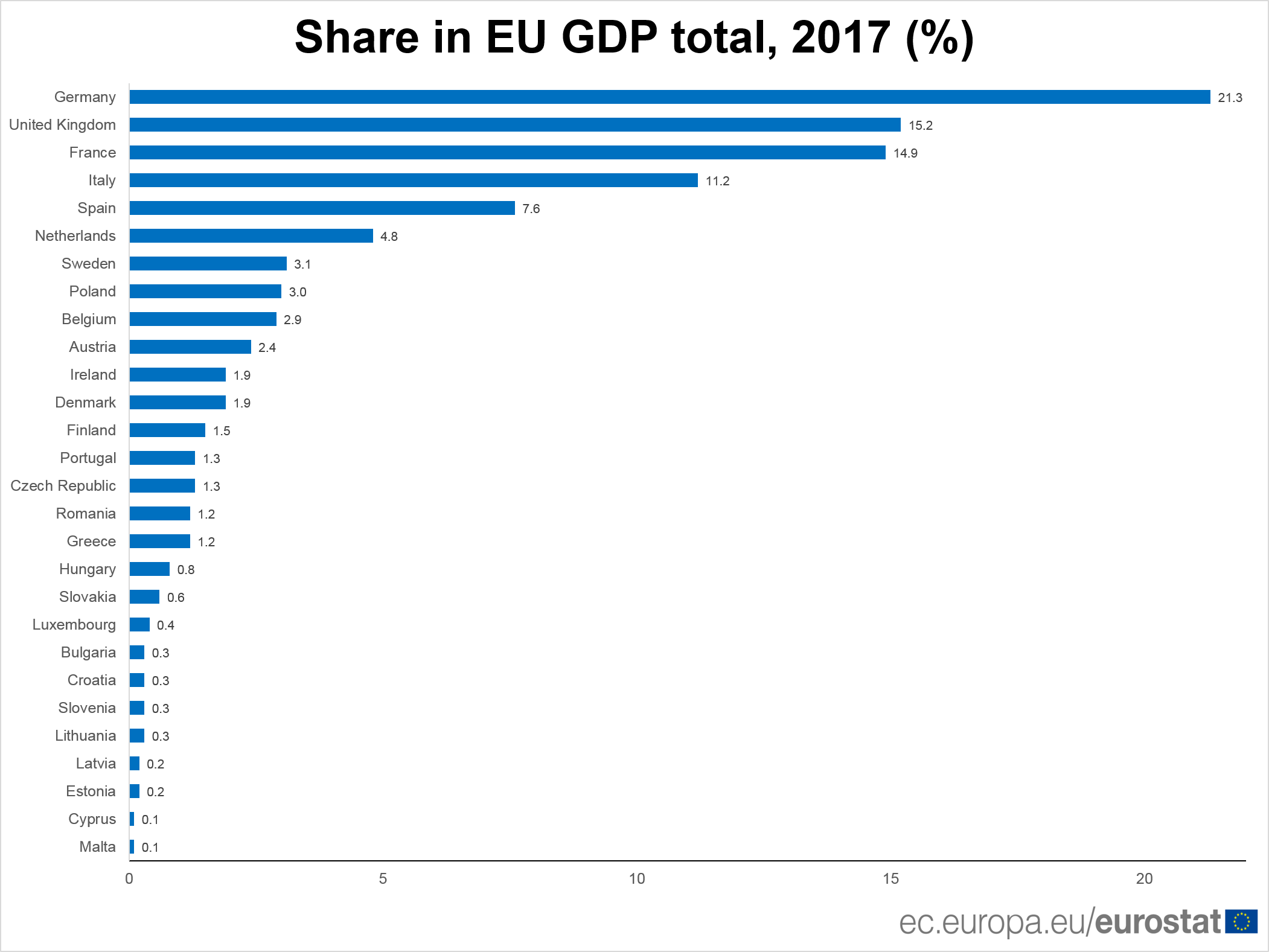

Which Member States have the largest share of EU’s GDP?

eurostat/2018/Which Member States have the largest share of EU’s GDP?/11 May The 19 Member States, which form the euro area, had a combined GDP of nearly €11 200 bn in 2017. The euro area accounted for 72.9% of the EU’s GDP. Germany (29.2%) and France (20.5%) together comprised half of the euro area GDP, while Italy (15.4%) and Spain (10.4%) made up a quarter. Relevant Posts Euro area economic and …Read More

A genie in a bottle: Inflation, globalisation, and competition

Dan Andrews, Peter Gal, William Witheridge, (2018), “A genie in a bottle: Inflation, globalisation, and competition”, VoxEU, 11 May Markets and commentators are speculating that there may be a sustained pick-up in inflation in the US, after years of subdued price pressures. Along with continued solid US jobs growth and low unemployment, there are tentative signs of higher wage growth and the fiscal stimulus will also boost short-term growth. Global …Read More

Real convergence in central, eastern and south-eastern Europe

Piotr Żuk, Eva Katalin Polgar, Li Savelin, Juan Luis Diaz del Hoyo and Paul König, (2018), “Real convergence in central, eastern and south-eastern Europe”, ECB, 10 May This article establishes stylised facts about convergence and analyses the sources of economic growth in central, eastern and south-eastern European (CESEE) economies within and outside the European Union (EU).22 It also compares the performance across countries and identifies the challenges that these economies …Read More

Financial literacy and inclusive growth in the European Union

Uuriintua Batsaikhan and Maria Demertzis, (2018), “Financial literacy and inclusive growth in the European Union”, Bruegel, 9 May Growing financialization and complexity demands financial literacy to be an integral part of the research agenda and policy design globally. It applies particularly to developed countries, since research findings suggest that financial literacy becomes more important with higher levels of economic development. Financial literacy is financial education, such as basic economics, statistics …Read More

Risk reduction and risk sharing in EU fiscal policymaking: The role of better fiscal rules

Roel Beetsma, Martin Larch, (2018), “Risk reduction and risk sharing in EU fiscal policymaking: The role of better fiscal rules”, VoxEU, 9 May The CEPR Policy Insight by 14 French and German economists (Bénassy-Quéré et al. 2018) marks a crucial stage in a long-lasting debate on how to reform the euro area. It offers a convincing synthesis in a discussion which until then had been held hostage by diametrically opposed …Read More

The Rise of Shadow Banking: Evidence from Capital Regulation

Rustom M Irani, Rajkamal Iyer, Ralf Meisenzahl, José Luis Peydró, (2018), “The Rise of Shadow Banking: Evidence from Capital Regulation”, CEPR, May We investigate the connections between bank capital regulation and the prevalence of lightly regulated nonbanks (shadow banks) in the U.S. corporate loan market. For identification, we exploit a supervisory credit register of syndicated loans, loan-time fixed-effects, and shocks to capital requirements arising from surprise features of the U.S. …Read More