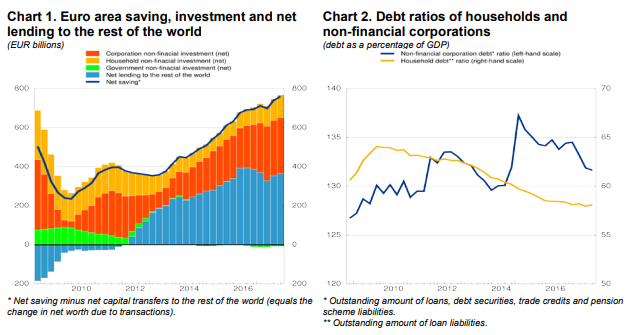

Euro area economic and financial developments by institutional sector: fourth quarter of 2017, 27 April 2018 Euro area saving (net, as a percentage of disposable income) was higher in the fourth quarter of 2017 than in the same quarter of the previous year. Total euro area non-financial investment (net) increased owing to higher investment by households and non-financial corporations (NFCs). Euro area net lending to the rest of the world …Read More

State contingent debt as insurance for euro-area sovereigns

Maria Demertzis & Stavros Zenios, (2018), “State contingent debt as insurance for euro-area sovereigns”, Bruegel, working paper, 26 April Since the financial crisis, EU countries’ economies have recovered to the point that they are exiting their adjustment programmes. Institutional stability mechanisms have been improved at the European level, with the promotion of the banking union and the establishment of a European Monetary Fund, for instance. However, the authors argue that …Read More

Eurostatistics: DATA FOR SHORT-TERM ECONOMIC ANALYSIS

Eurostatistics/DATA FOR SHORT-TERM ECONOMIC ANALYSIS/04-2018 The annual GDP growth rate of the euro area was 2.7% in Q4 2017, stable compared to Q3. The ESI (Economic Sentiment Indicator) declined for a third month in a row reaching 112.6 in March 2018 (–1.6 points). European Union and euro area: Annual GDP growth stable in Q4 2017 in the euro area The annual GDP growth rate of the euro area was …Read More

How income gains from globalisation are distributed

Valentin Lang, Marina Mendes Tavares, (2018), “How income gains from globalisation are distributed”, 27 April On few economic developments of the recent decades are the sentiments so diverse as they are on globalisation. Some credit globalisation with boosting economic well-being and reducing poverty. Others blame it for leading to appallingly high levels of inequality, benefitting a few, while leaving many behind. These recent trends have supported the political backlash against …Read More

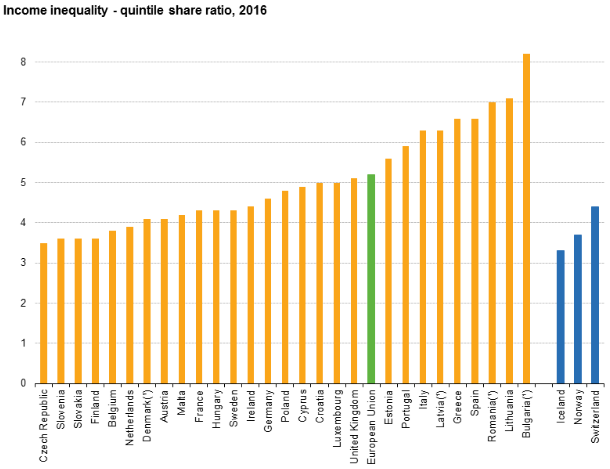

Income inequality in the EU

Eurostat/Income inequality in the EU/26 April 2018 Data from 2016 show wide inequalities in the distribution of income. In the EU, the top 20% of the population (with the highest income) received 5.2 times as much income as the bottom 20%. This ratio varied considerably across the Member States, from 3.5 in the Czech Republic and 3.6 in Slovenia, Slovakia and Finland, to 6.0 or more in Bulgaria (8.2), Lithuania …Read More

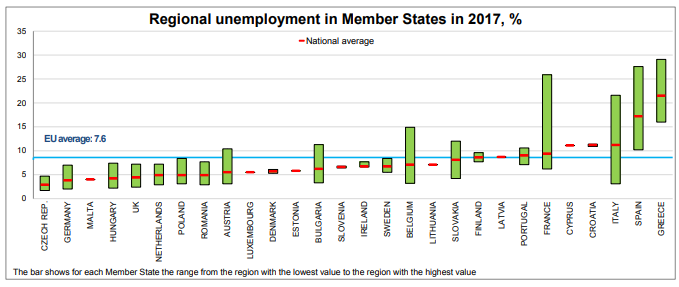

Unemployment rates in the EU regions ranged from 1.7% to 29.1%

Eurostat/Unemployment rates in the EU regions ranged from 1.7% to 29.1%/26 April 2018 At the end of the fourth quarter of 2017, the government debt to GDP ratio in the euro area (EA19) stood at 86.7%, compared with 88.1% at the end of the third quarter of 2017. In the EU28, the ratio also decreased from 82.4% to 81.6%. Compared with the fourth quarter of 2016, the government debt to …Read More

The Logical Next Step for Europe’s Integration

Ferdinando Giugliano, (2018), “The Logical Next Step for Europe’s Integration”, BloomberView, 25 April For the past year, euro-zone leaders have vowed to take steps to complete Europe’s monetary union. The 19 countries share a single currency and a central bank, but they still lack all the necessary mechanisms to deal with major imbalances and shocks. While some members would like to have more fiscal transfers and a common safety net …Read More

Labour market policies in the era of pervasive austerity A European perspective

Sotiria Theodoropoulou, (2018), “Labour market policies in the era of pervasive austerity. A European perspective”, policy press This book investigates the changing patterns of labour market and unemployment policies in EU member states during the period since fiscal austerity took hold in 2010 during the deepest postwar recession in Europe. Looking at the big European picture, do we see a convergence or a divergence in labour market and unemployment policy …Read More

Debt Overhang, Rollover Risk, and Corporate Investment: Evidence from the European Crisis

Sebnem Kalemli-Ozcan, Luc Laeven, David Moreno, (2018), “Debt Overhang, Rollover Risk, and Corporate Investment: Evidence from the European Crisis”, discussion paper, CEPR We quantify the role of financial factors that have contributed to sluggish investment in Europe in the aftermath of the 2008-2009 crisis. Using a big data approach, we match the firms to their banks based on banking relationships in 8 European countries over time, obtaining over 2 million …Read More

Deepening EMU requires a coherent and well-sequenced package

Marco Buti, Gabriele Giudice, José Leandro, (2018), “Deepening EMU requires a coherent and well-sequenced package”, 24 April The debate on EMU deepening is entering a critical stage. The contribution of 14 French and German economists (Benassy-Quéré et al. 2018) is therefore timely. It suggests ways for reconciling risk-sharing with market discipline – where the biggest divisions lie. Their initiative overlaps in spirit and with much of the substance of the …Read More