Guy Standing, (2018), “Rentier Capitalism And Basic Income”, Social Europe, 28 March Rental income has been boosted by increased firm concentration in many economic sectors – epitomised by the rise of ‘superstar firms’ – and by government action, most notably the strengthening of intellectual property rights protection and the growth of the subsidy state, as governments have chosen to compete by throwing subsidies at large corporations and rich individuals. In …Read More

Do wide-reaching reform programmes foster growth?

Alessio Terzi, Pasquale Marco Marrazzo, (2018), “Do wide-reaching reform programmes foster growth?”, Bruegel, 28 March With growth gathering momentum in the eurozone, some have claimed this is the proof that structural reforms implemented during the crisis are working, re-opening the long-standing debate on the extent to which reforms contribute to fostering long-term growth. This column employs a novel empirical approach – a modified version of the Synthetic Control Method – …Read More

The American Economy: A European view

Anton Brender,Florence Pisani, (2018), “The American Economy: A European view”, CEPS, 23 March Each year, 25% of the world’s output is produced by less than 5% of the planet’s population. The juxtaposition of these two figures gives an idea of the power of the American economy. Not only is it the most productive among the major developed economies, but it is also a place where new products, services and production …Read More

Managing public debt in Europe: an introductory guide

Sotiria Theodoropoulou, (2018), “Managing public debt in Europe: an introductory guide”, European Trade Union Institute, Brussels This new introductory guide, ‘Managing public debt in Europe, reviews the debate and empirical evidence on the problems that high public debt may cause and the policy options for reducing it. To do so, it starts from the basics regarding the determinants of the evolution of public debt over time, explains under what conditions …Read More

Domestic banks as lightning rods? Home bias during the eurozone crisis

Orkun Saka,(2018), “Domestic banks as lightning rods? Home bias during the eurozone crisis”, CEPS, 28 March European banks have been criticized for holding excessive domestic government debt during economic downturns, which has been interpreted as indicative evidence of moral suasion. By using a novel bank-level dataset covering the entire timeline of the eurozone crisis, I first re-confirm that the crisis led to the reallocation of sovereign debt from foreign to …Read More

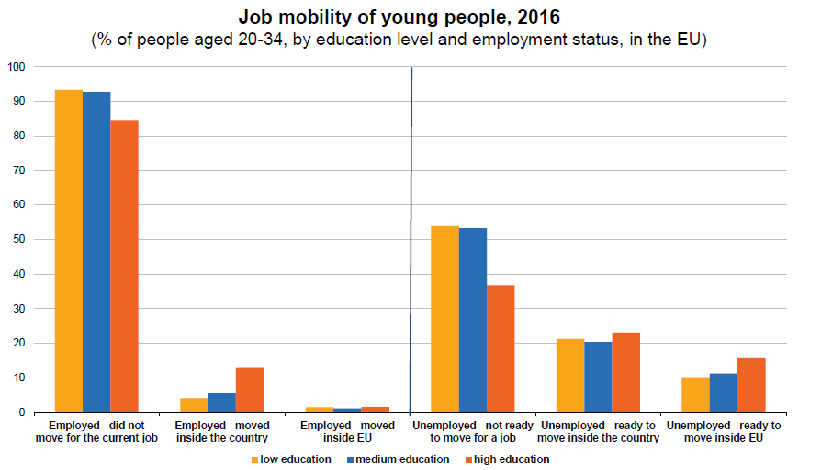

Half of unemployed young people in the EU ready to relocate for a job

Eurostat/Half of unemployed young people in the EU ready to relocate for a job/27 March 2018 Less than 1% of young employed moved to another EU Member State for their current job. 50% of unemployed people aged 20-34 in the European Union (EU) are reluctant to change their place of residence for a job, 21% are ready to move for a job but only in the same country, whereas 12% would consider moving to another …Read More

The Lesser Evil for the Eurozone

Jean Pissany Ferry, (2018), “The Lesser Evil for the Eurozone”, Project Syndicate, 27 March For three decades, the consensus within the European Commission and the European Central Bank on the need for market reforms and sound public finances has been strong enough to overcome opposition in small countries and outlast procrastination in large ones. Today, however, the eurozone playing field has become a battleground. Relevant Posts Camilo E Tovar Mora, Tania …Read More

A minimal moral hazard central stabilisation capacity for the EMU based on world trade

Roel Beetsma, Simone Cima,Jacopo Cimadomo, (2018), “A minimal moral hazard central stabilisation capacity for the EMU based on world trade”, No 2137 , March 2018 Recent debate has focused on the introduction of a central stabilisation capacity as a completing element of the Economic and Monetary Union. Its main objective would be to contribute cushioning country-specific economic shocks, especially when national fiscal stabilisers are run down. There are two main potential objections to such schemes proposed so …Read More

Regulatory cycles: Revisiting the political economy of financial crises

Jihad Dagher,(2018), “Regulatory cycles: Revisiting the political economy of financial crises”, Vox.eu, 22 March Back in early 2017, while the stock market was breaking records, the new administration in the US made promises to significantly roll back the recently implemented regulations under the Dodd-Frank Act. We have seen the move toward deregulation take shape on various fronts. By most accounts, new regulatory appointees have signalled a shift toward a softer approach …Read More

Europe’s `Safe Bonds’ Are Not So Safe After All

Ferdinando Giugliano, (2018), “Europe’s `Safe Bonds’ Are Not So Safe After All”, Bloomberg, 22 Μarch Call it the Holy Grail of the euro zone. Ever since the financial crisis, economists have been seeking ways to create a safe financial instrument, which banks in the single currency area can buy without having to load up on domestic sovereign bonds. Many placed their hopes in the proposal of a bundle of sovereign bonds …Read More