Dani Rodrik, (2018), “In Defense of Economic Populism”, Project Syndicate, 9 January Populists’ aversion to institutional restraints extends to the economy, where they oppose obstacles placed in their way by autonomous regulatory agencies, independent central banks, and global trade rules. But while populism in the political domain is almost always harmful, economic populism can sometimes be justified. Relevant Posts David Vines Samuel Wills, (2018), «The rebuilding macroeconomic theory project: an analytical assessment …Read More

Ready or Not for the Next Recession?

Barry Eichengreen, (2018), “Ready or Not for the Next Recession?”, Project Syndicate, 10 January Policymakers normally respond to recessions by cutting interest rates, reducing taxes, and boosting transfers to the unemployed and other casualties of the downturn. But, for a combination of economic and political reasons, the US, in particular, is singularly ill-prepared to respond normally. Relevant Posts David Vines Samuel Wills, (2018), «The rebuilding macroeconomic theory project: an analytical assessment «, Oxford …Read More

The rebuilding macroeconomic theory project: an analytical assessment

David Vines Samuel Wills, (2018), “The rebuilding macroeconomic theory project: an analytical assessment “, Oxford Review of Economic Policy, Volume 34, Issue 1-2, 5 January In this paper we review the Rebuilding Macroeconomic Theory Project, in which we asked a number of leading macroeconomists to describe how the benchmark New Keynesian model might be rebuilt, in the wake of the 2008 crisis. The need to change macroeconomic theory is similar to the situation …Read More

GDP at risk

Stephen Cecchetti, Kim Schoenholtz, (2018), “GDP at risk”, Vox, 11 January The likelihood of another crisis-induced plunge in GDP is much lower today than it was a decade ago, but we are still at an early stage of building a financial stability policy framework that corresponds to the inflation-targeting framework that forms the basis for monetary policy. This column describes a step forward in developing such framework – the concept …Read More

Income Convergence in the EU: A tale of two speeds

Cinzia Alcidi, Jorge Núñez Ferrer, Mattia Di Salvo,Roberto Musmeci and Marta Pilati, (2018), “Income Convergence in the EU: A tale of two speeds”, CEPS, 9 January Since their original formulation, the reception given to the concepts of convergence and cohesion has alternated between wild enthusiasm and near dismissal in the EU debate. (…) As the ongoing economic recovery is still characterised by significant differencesin growth rates across member states, there is a growing …Read More

Why does economics get so much stick?

Mainly Macro, (2018), “Why does economics get so much stick?”, 9 January Because the advice of economists is so hopeless, you may say. Well think about the following thought experiment. After the financial crisis. suppose people had done the opposite of what the majority of economists said they should do. We do not need to imagine over Brexit, because most of the 52% who voted for Brexit chose to ignore, …Read More

OECD annual inflation picks up to 2.4% in November 2017

OECD, (2018), “OECD annual inflation picks up to 2.4% in November 2017”, 9 January Annual inflation in the OECD area picked up for the fifth consecutive month in November 2017, to 2.4%, compared with 2.2% in October 2017. This increase in the annual rate of inflation was driven by both energy and food prices. Energy price inflation rose to 7.7% in November, compared with 5.8% in October, while food price inflation rose to …Read More

Tight monetary policy is not the answer to weak productivity growth

Maurice Obstfeld, Romain Duval, (2018), “Tight monetary policy is not the answer to weak productivity growth”, Vox, 10 January The widespread and persistent productivity slowdown witnessed since the Global Crisis had already begun in advanced and low-income countries prior to the crisis. This column argues that the crisis amplified the slowdown by creating ‘productivity hysteresis’, and that monetary policy played an ambiguous role. Policymakers must now address the legacies of the …Read More

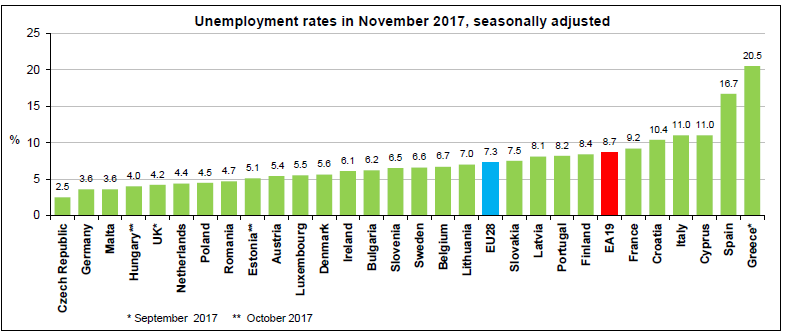

Euro area unemployment at 8.7%

Eurostat/Euro area unemployment at 8.7%/9 January 2018 The euro area (EA19) seasonally-adjusted unemployment rate was 8.7% in November 2017, down from 8.8% in October 2017 and from 9.8% in November 2016. This is the lowest rate recorded in the euro area since January 2009. The EU28 unemployment rate was 7.3% in November 2017, down from 7.4% in October 2017 and from 8.3% in November 2016. This is the lowest rate recorded in the …Read More

Will Monetary Policy Trigger Another Financial Crisis?

Alexander Friedman, (2017), “Will Monetary Policy Trigger Another Financial Crisis?”, Project Syndicate, 21 December Sustained unconventional monetary policies in the years after the 2008 global financial crisis created the conditions for the second-longest bull market in history. But they also may have sown the seeds of the next financial crisis, which might take root as central banks continue to normalize their policies and shrink their balance sheets. Relevant Posts Michael …Read More