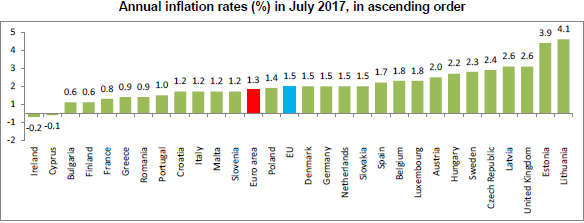

Eurostat/Annual inflation stable at 1.3% in the euro area/17 August 2017 Euro area annual inflation was 1.3% in July 2017, stable compared with June 2017. In July 2016 the rate was 0.2%. European Union annual inflation was 1.5% in July 2017, also stable compared to June 2017. A year earlier the rate was 0.2%. These figures come from Eurostat, the statistical office of the European Union. Relevant Posts Eurostat/Annual inflation …Read More

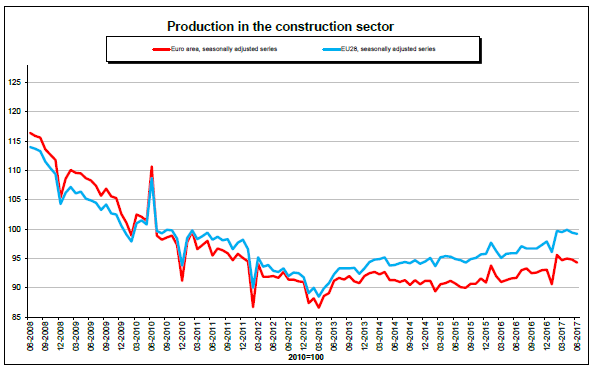

Production in construction down by 0.5% in euro area

Eurostat/Production in construction down by 0.5% in euro area/18 August 2017 In June 2017 compared with May 2017, seasonally adjusted production in the construction sector decreased by 0.5% in the euro area (EA19) and by 0.2% in the EU28, according to first estimates from Eurostat, the statisticaloffice of the European Union. In May 2017, production in construction fell by 0.2% in the euro area and by 0.5% in the EU28. …Read More

Bank Consolidation, Efficiency, and Profitability in Italy

Weber, Anke, (2017), “Bank Consolidation, Efficiency, and Profitability in Italy”, International Monetary Fund (IMF) Working Paper No.17/175, 27 July This paper examines the case for efficiency-driven banking sector consolidation in Italy, evaluates its potential effects on profitability, and discusses policy options to facilitate a consolidation process that is as effective as possible. A bottom-up analysis of 386 Italian banks suggests that while profitability is expected to improve as the economy …Read More

The role of foreign slack in domestic inflation in the Eurozone

Nickel, Christiane, (2017), “The role of foreign slack in domestic inflation in the Eurozone”, VoxEU, 28 July The past decade has seen a growing role for global slack in Phillips curve approaches, as opposed to the traditional focus on domestic slack. This column explores whether augmenting Phillips curves by measures of foreign slack can help to better explain past developments in underlying inflation. A majority of specifications, both with and …Read More

On secular stagnation and low interest rates: demography matters

Ferrero, Giuseppe, Gross, Marco, Neri, Stefano, (2017), “On secular stagnation and low interest rates: demography matters”, European Central Bank (ECB) Working Paper Series No 2088, July Nominal and real interest rates in advanced economies have been decreasing since the mid-1980s and reached historical low levels in the aftermath of the global financial crisis. Understanding why interest rates have fallen is essential for both monetary policy and financial stability. This paper …Read More

Italian economic growth and the Euro

Papadia, Francesco, (2017), “Italian economic growth and the Euro”, Bruegel, 26 July While the Euro has frequently been blamed for the poor growth performance of Italy over the years, a long-term analysis shows deteriorating growth before the introduction of the Euro. Additionally, Italy has shown worse performance than other euro-periphery countries, such as Spain, implying deeper structural reasons for Italy’s economic malaise. Relevant Posts Giugliano, Ferdinando, (2017), «Europe’s Banking Union …Read More

The international effects of ECB’s monetary policy

Merler, Silvia, (2017), “The international effects of ECB’s monetary policy”, Bruegel, 24 July What’s at stake: the literature on monetary policy spillovers is abundant of studies investigating the impact of the US Federal Reserve’s monetary policy announcements and actions on emerging market economies. More recently, economists have been investigating the effect of the ECB’s credit easing as well. Relevant Posts European Central Bank (ECB), (2017), «The international role of the …Read More

A Firming Recovery

Obstfeld, Maurice, (2017), “A Firming Recovery”, IMF Blog, 24 July The recovery in global growth that we projected in April is on a firmer footing; there is now no question mark over the world economy’s gain in momentum. As in our April forecast, the World Economic Outlook Update projects 3.5 percent growth in global output for this year and 3.6 percent for next. The distribution of this growth around the world has changed, …Read More

Five views: Is populism really a threat to democracy?

LSE EUROPP, (2017), “Five views: Is populism really a threat to democracy?”, 24 July Donald Trump’s victory in the 2016 US presidential election, the UK’s decision to leave the EU, and the rise of anti-establishment parties across Europe have prompted discussions over the role of ‘populism’ in modern politics. But is populism really a threat to democracy or is the term simply used by mainstream politicians to dismiss the legitimate …Read More

World Economic Outlook Update, July 2017

International Monetary Fund, (2017), “World Economic Outlook Update”, July 2017 The pickup in global growth anticipated in the April World Economic Outlook remains on track, with global output projected to grow by 3.5 percent in 2017 and 3.6 percent in 2018. While risks around the global growth forecast appear broadly balanced in the near term, they remain skewed to the downside over the medium term. On the upside, the cyclical rebound could …Read More