DeGrauwe, Paul, (2016), “The EU Should Take The Side Of The Losers Of Globalization”, Social Europe, 4 July How should the European Union react to the decision of the British people to withdraw from the union? This is the question that is at the center of the political debate in Europe. The starting point in trying to answer this question is the observation that the European Union has a very negative image …Read More

Macroeconomics in Germany: The forgotten lesson of Hjalmar Schacht

Bossone, Biagio, Labini, Stefano Sylos, (2016), “Macroeconomics in Germany: The forgotten lesson of Hjalmar Schacht”, VoxEU, 1 July Despite facing many of the same challenges, Germany’s current macroeconomic policy is substantially different to those of other countries, in part due to the economy legacy of Walter Eucken. This column considers the economic policy of Hjalmar Schacht, whose ‘MEFO-bills’ monetary solution ended the years of economic struggle caused by the Treaty of …Read More

Banking Union in Historical Perspective: The Initiative of the European Commission in the 1960s–1970s

Mourlon-Druol, Emmanuel, (2016), “Banking Union in Historical Perspective: The Initiative of the European Commission in the 1960s–1970s”, JCMS Vol. 54, Iss. 4, July This article shows that planning for the organization of EU banking regulation and supervision did not just appear on the agenda in recent years with discussions over the creation of the eurozone banking union. It unveils a hitherto neglected initiative of the European Commission in the 1960s and early 1970s. …Read More

The Changing Nature of Gender Selection into Employment: Europe over the Great Recession

Juan J. Dolado, Cecilia Garcia-Penalosa, Linas Tarasonis, (2016), “The Changing Nature of Gender Selection into Employment: Europe over the Great Recession”, CEPR DP 11367, Ιούνιος The aim of this paper is to evaluate the role played by selectivity issues induced by nonemployment in explaining gender wage gap patterns in the EU since the onset of the Great Recession. We show that male selection into the labour market, traditionally disregarded, has increased. …Read More

Quantitative Easing: The Challenge for Households Long-term Savings and Financial Security

Thimann, Christian, (2016), “Quantitative Easing: The Challenge for Households Long-term Savings and Financial Security”, CESifo Working Paper No. 5976, June The extremely low long-term interest rates in capital markets, to a relevant extent induced by quantitative easing, imply significant challenges for retirement saving and the stability of households’ purchasing power over the long-term. The reason is that prices for the two most important long-term savings objectives – housing and healthcare – are …Read More

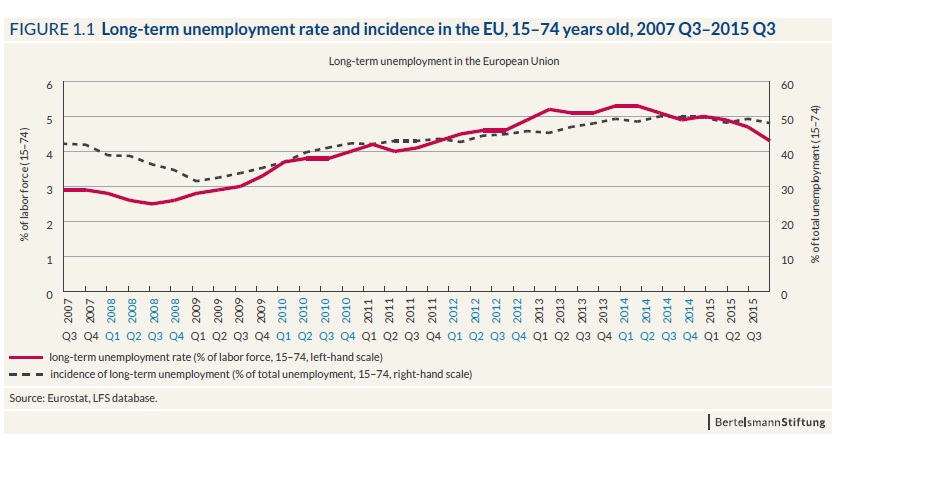

Long-term Unemployment in the EU: Trends and Policies

Duell, Nicola, Thurau, Lena, Vetter. Tim, (2016), “Long-term Unemployment in the EU: Trends and Policies”, Bertelsmann Stiftung Study, 2016 As a consequence of the 2008 global economic and financial crisis, long-term unemployment has, yet again, become one of the key issues on the European labor market. In the third quarter of 2015, the European Union recorded some 22 million unemployed. Nearly half of these individuals (48.2 %) were unemployed for 12 months …Read More

The greatest reshuffle of individual incomes since the Industrial Revolution

Milanovic, Branko, (2016), “The greatest reshuffle of individual incomes since the Industrial Revolution”, Voxeu, 1 July The effects of of globalisation on income distributions in rich countries have been studied extensively. This column takes a different approach by looking at developments in global incomes from 1988 to 2008. Large real income gains have been made by people around the median of the global income distribution and by those in the global top …Read More

The public economics of long term care

Pestieau, Pierre, Ponthiere, Gregory, (2016), “The public economics of long term care”, Centre for Economic Policy Reseach, June With the rapid increase in LTC needs, the negligible role of the market and the declining role of informal family care, one would hope that the government would take a more proactive role in the support of dependent elderly, particularly those who cannot, whatever the reason, count on assistance from their family. The …Read More

Germany : Financial Sector Assessment Program-Financial System Stability Assessment

International Monetary Fund, (2016), “Germany : Financial Sector Assessment Program-Financial System Stability Assessment”, IMF Publications, 29 June The country is home to two global systemically important financial institutions, Deutsche Bank AG and Allianz SE, as well as to one of the largest global central counterparties (CCP), Eurex Clearing AG. The system is also very heterogeneous, with a range of business models and a large number of smaller banks and insurers. …Read More

Government as Borrower of First Resort

Chemla, Gilles, Hennessy, Christopher, (2016), “Government as Borrower of First Resort”, Centre for Economic Policy Research, June We examine optimal provision of riskless government bonds under asymmetric information and safe asset scarcity. Paradoxically, corporations have incentives to issue junk debt precisely when intrinsic demand for safe debt is high since uninformed investors then migrate to risky overheated debt markets. Uninformed demand stimulates informed speculation which drives junk debt prices closer to fundamentals, encouraging …Read More