Sotiria Theodoropoulou, (2018), “Labour market policies in the era of pervasive austerity. A European perspective”, policy press This book investigates the changing patterns of labour market and unemployment policies in EU member states during the period since fiscal austerity took hold in 2010 during the deepest postwar recession in Europe. Looking at the big European picture, do we see a convergence or a divergence in labour market and unemployment policy …Read More

Debt Overhang, Rollover Risk, and Corporate Investment: Evidence from the European Crisis

Sebnem Kalemli-Ozcan, Luc Laeven, David Moreno, (2018), “Debt Overhang, Rollover Risk, and Corporate Investment: Evidence from the European Crisis”, discussion paper, CEPR We quantify the role of financial factors that have contributed to sluggish investment in Europe in the aftermath of the 2008-2009 crisis. Using a big data approach, we match the firms to their banks based on banking relationships in 8 European countries over time, obtaining over 2 million …Read More

Deepening EMU requires a coherent and well-sequenced package

Marco Buti, Gabriele Giudice, José Leandro, (2018), “Deepening EMU requires a coherent and well-sequenced package”, 24 April The debate on EMU deepening is entering a critical stage. The contribution of 14 French and German economists (Benassy-Quéré et al. 2018) is therefore timely. It suggests ways for reconciling risk-sharing with market discipline – where the biggest divisions lie. Their initiative overlaps in spirit and with much of the substance of the …Read More

EU banks rush to ‘have cake and eat it’ with bad loan sales

Martin Arnold (2018), “EU banks rush to ‘have cake and eat it’ with bad loan sales”, Financial Times, 23 April Southern European banks have taken more than €14bn in extra provisions this year to write down the value of toxic loans they plan to sell, while taking advantage of a new accounting rule to delay the hit to capital. Analysts say the opportunity for banks to “have their cake and eat …Read More

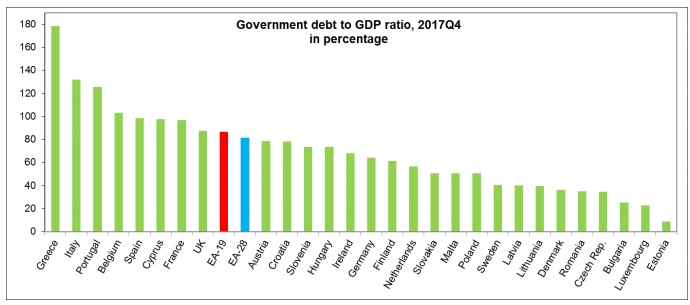

Government debt fell to 86.7% of GDP in euro area

Eurostat/Government debt fell to 86.7% of GDP in euro area/24 April 2018 At the end of the fourth quarter of 2017, the government debt to GDP ratio in the euro area (EA19) stood at 86.7%, compared with 88.1% at the end of the third quarter of 2017. In the EU28, the ratio also decreased from 82.4% to 81.6%. Compared with the fourth quarter of 2016, the government debt to GDP …Read More

The curse of persistently low real interest rates

Jan Willem van den End, Marco Hoeberichts, (2018), “The curse of persistently low real interest rates”, VoxEU, 25 April The steady downward trend of real interest rates worldwide over the last 30 years has raised the issue of whether the natural rate – defined by Wicksell (1898) as the marginal productivity of capital – has fallen in tandem. Blanchard et al. (2014) conclude that the factors that led to low …Read More

H E.E. θα ενισχύσει κράτη του Νότου όπως η Ελλάδα, αντί χωρών της ανατολικής Ευρώπης

Alex Barker, (2018), “EU budget revamp set to shift funds to southern states”, Financial Times, 22 April Brussels plans to shift tens of billions of euros in EU funding away from central and eastern Europe, diverting money from countries such as Poland, Hungary and the Czech Republic to those hit hard by the financial crisis such as Spain and Greece. The reforms will be one of the most contentious parts …Read More

The impact of industrial robots on EU employment and wages: A local labour market approach

Francesco Chiacchio Georgios Petropoulos David Pichler, (2018), “The impact of industrial robots on EU employment and wages: A local labour market approach”, working paper, issue 02, bruegel, 18 April The authors of this working paper study the impact of industrial robots on employment and wages in six European Union countries, which make up 85.5 percent of the EU industrial robots market. In theory, robots can directly displace workers from performing …Read More

Banks, Non-Performing Loans and Investment

Daniel Gros, (2018), “Banks, Non-Performing Loans and Investment”, CEPS, 17 April In this editorial, CEPS Director Daniel Gros analyses the effects of non-performing loans (NPLs) on the broader Italian credit and banking sector, with a specific reference to France and Germany, He argues that NPLs do not hamper the possibilities of economic growth. Europe’s banks still have very large amounts of non-performing loans on their books. According to some estimates, …Read More

Corporate investment in Europe: The role of finance

Philipp-Bastian Brutscher, Jonas Heipertz, Christopher Hols, (2018), “Corporate investment in Europe: The role of finance”, VoxEU, 23 April The question of how firms finance their business and investment activity is long-standing in the academic literature as well as in policy circles. Indeed, the availability of sufficient sources of funding is at the heart of the dynamics and functioning of market economies. The stabilising role of monetary policy relies on the …Read More