Nicolas Veron, (2017), “Sovereign Concentration Charges: A New Regime for Banks’ Sovereign Exposures”, Bruegel, 17 November Europe’s banking union has been central to the resolution of the euro-area crisis. It has had an encouraging start but remains unfinished business. If it remains in its current halfway-house condition, it may eventually move backwards and fail. EU leaders should seize these opportunities Relevant Posts Kizys, Renatas, Paltalidis, Nikos, Vergos, Konstantinos, (2015), «Bailouts …Read More

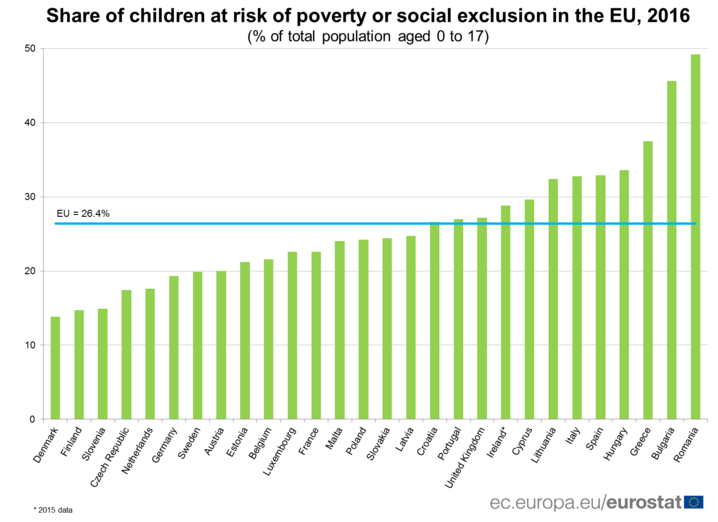

EU children at risk of poverty or social exclusion

Eurostat/EU children at risk of poverty or social exclusion/20 November 2017 In 2016, 24.8 million children in the European Union (EU), or 26.4% of the population aged 0 to 17, were at risk of poverty or social exclusion. This means that the children were living in households with at least one of the following three conditions: at-risk-of-poverty after social transfers (income poverty), severely materially deprived or with very low work …Read More

Confidence in euro zone expansion strong among economists

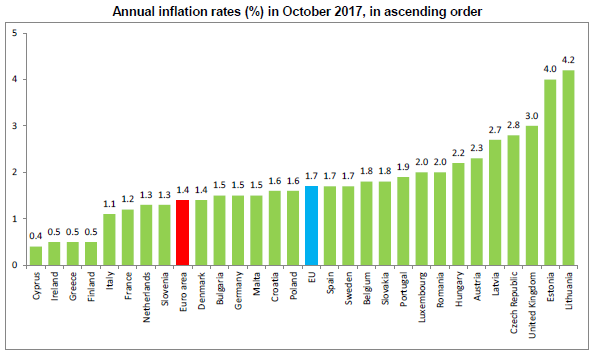

Mumal Rathore, Shrutee Sarkar, (2017), “Confidence in euro zone expansion strong among economists”, Reuters, 17 November The euro zone economy will mark its best year in a decade and maintain solid growth well into 2018, according to economists in a Reuters poll who said the risk was that their forecasts might not be optimistic enough. Inflation, last clocked at 1.4 percent, is expected to stay below the European Central Bank’s target …Read More

Annual inflation down to 1.4% in the euro area

Eurostat/Annual inflation down to 1.4% in the euro area/16 November 2017 Euro area annual inflation was 1.4% in October 2017, down from 1.5% in September. In October 2016, the rate was 0.5%. European Union annual inflation was 1.7% in October 2017, down from 1.8% in September. A year earlier the rate was 0.5%. These figures come from Eurostat, the statistical office of the European Union. Relevant Posts Eurostat/Euro area annual inflation down …Read More

Fiscal Spillovers in the Euro Area: Letting the Data Speak

Era Dabla-Norris, Pietro Dallari, Tigran Poghosyan, (2017), “Fiscal Spillovers in the Euro Area: Letting the Data Speak”, IMF Working Paper No. 17/241, 15 Νovember We estimate a panel VAR model that captures cross-country, dynamic interlinkages for 10 euro area countries using quarterly data for the period 1999-2016. Our analysis suggests that fiscal spillovers are significant and tend to be larger for countries with close trade and financial links as well, as for fiscal …Read More

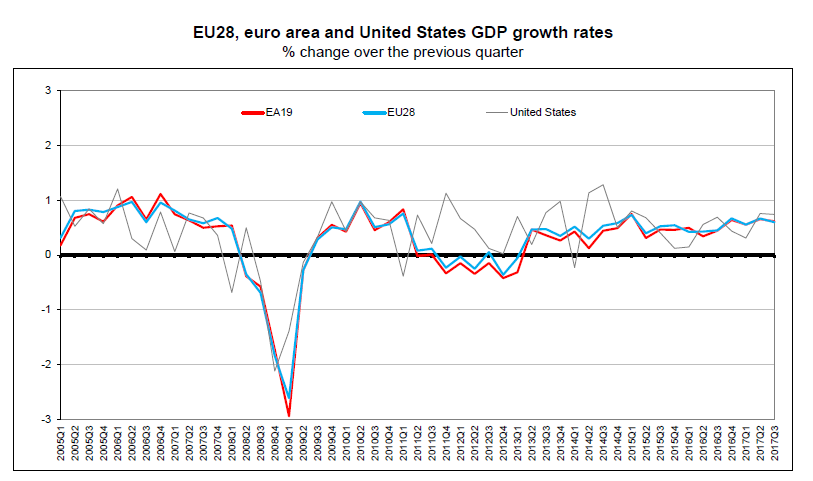

GDP up by 0.6% in both euro area and EU28

Eurostat/GDP up by 0.6% in both euro area and EU28/14 Νοvember, 2017 Seasonally adjusted GDP rose by 0.6% in both the euro area (EA19) and the EU28 during the third quarter of 2017, compared with the previous quarter, according to a flash estimate published by Eurostat, the statistical office of the European Union. In the second quarter of 2017, GDP grew by 0.7% in both zones. Compared with the same quarter of the …Read More

Democracy Beyond the Nation-State

Kemal Dervis, (2017), “Democracy Beyond the Nation-State”, Project Syndicate, 14 Νovember According to the Harvard economist Dani Rodrik, it is impossible to have full national sovereignty, democracy, and globalization simultaneously. The concept of a “political trilemma of the world economy” is useful, but it becomes less binding when one takes into account levels of government above and especially below the nation-state. Relevant Posts Harold James, (2017), «Europe’s Hard-Core Problem», Project …Read More

A ‘twin peaks’ vision for Europe

Dirk Schoenmaker, Nicolas Veron, (2017), “A ‘twin peaks’ vision for Europe”, Bruegel, 13 November The organisation of the European Supervisory Authorities (ESAs) is based on a sectoral approach with one ESA for each sector, with separate authorities for banking, insurance and securities and markets. But is this sectoral approach still valid? This Policy Contribution outlines a long-term vision for the supervisory architecture in the European Union. Relevant Posts Francesco Papadia, …Read More

The ECB Needs an Inflation Plan, Just in Case

Ferdinando Giugliano, (2017). “The ECB Needs an Inflation Plan, Just in Case”, Bloomberg, 14 November Nearly three weeks after the European Central Bank halved the pace of its monetary stimulus to the euro zone economy, something strange is happening in the sovereign debt market.Even as the ECB takes a little step back from quantitative easing, investors are continuing to pile into government bonds, particularly from some countries that were most …Read More

Understanding and Managing Financial Interdependence

Maurice Obstfeld, (2017), “Understanding and Managing Financial Interdependence”, IMF Blog, 8 November The 18th Annual Jacques Polak Annual Research Conference last week opened with Managing Director Christine Lagarde noting the ebb and flow of capital movements into emerging market and developing economies since the turn of the millennium. She asked three questions at the heart of the discussion, and to which speakers returned consistently during the conference: How do advanced-country …Read More