Eisenbach, Thomas, Lucca, David, Townsend, Robert, (2016), ” The economics of bank supervision: Theory and evidence “, Voxeu, 17 June 2016, The two main elements of bank industry oversight are regulation and supervision. This column provides a framework for thinking about supervision in relation to regulation. Using US data on supervisory hours spent, it finds evidence of economies of scale for bank size. Additionally, less risky banks receive substantially lower amounts of supervisory hours. The findings …Read More

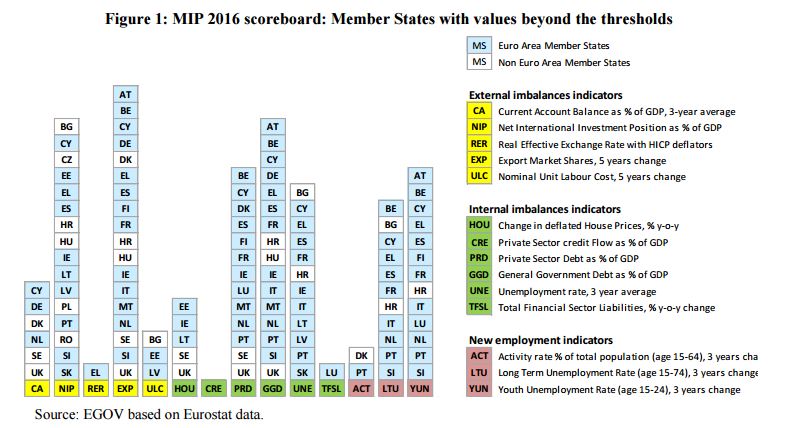

Implementation of the Macroeconomic Imbalance Procedure

A. Zoppè, (2016), “Implementation of the Macroeconomic Imbalance Procedure”, EuroParl EGOV PE 497.739, 16 Ιουνίου This note presents the Member States’ situation with respect to the Macroeconomic Imbalance Procedure (MIP) taking into account recent assessments and decisions by the European Commission, as well as documents published by other relevant European institutions. This document is regularly updated. A separate EGOV note describes the MIP procedure. On the basis of the economic reading of …Read More

Ιn Defense of Europe. Can the European project be saved?

Tsoukalis, Loukas, (2016), “Ιn Defense of Europe. Can the European project be saved?”, Oxford University Press Το νέο βιβλίο του Προέδρου του ΕΛΙΑΜΕΠ, Καθηγητή Λουκά Τσούκαλη: Ιn Defense of Europe. Can the European project be saved? εκδίδεται από τον οίκο Oxford University Press. Για πολλά χρόνια η Ευρώπη δεν ήταν τόσο αδύναμη και διχασμένη, όπως συμβαίνει σήμερα. Τραυματισμένη από διαδοχικές κρίσεις, έχει δείξει ισχυρό συλλογικό ένστικτο επιβίωσης αλλά δεν έχει ανταποκριθεί …Read More

OECD Business and Finance Outlook 2016

OECD, (2016), “OECD Business and Finance Outlook 2016”, OECD, 9 June It is seven years since the global crisis and despite easy monetary policy, financial regulatory reform, and G20 resolutions favouring structural measures, the world economy is not making a lot of progress. Indeed, the responses to the crisis seem mainly to have stopped the banks from failing and then pushed the many faces of the crisis around between regions—currently …Read More

Germany’s world: power and followership in a crisis-ridden Europe

Hellmann, Gunther, (2016), “Germany’s world: power and followership in a crisis-ridden Europe”, Global Affairs, Volume 2 Issue 1, 11 Μay EUrope and Germany face unprecedented crises. Given its role as EUrope’s “central power” the article explores how Germany looks at its environment and how the world looks back. I offer five cuts of Germany’s world, that is, how its power, place and ambition might be described from different angles. First, I …Read More

Rules of the monetary game

Mishra, Prachi, (2016), “Rules of the monetary game”, VoxEU, 16 June All monetary policies have external spillover effects. However, the domestic mandates of most central banks may not legally allow them to take spillovers into account, and may force them to undertake aggressive policies so long as they have some small positive domestic effect. This column looks at the rules of the game for responsible policy in such a context. It …Read More

Financial Scarcity Amid Plenty

Eichengreen, Barry, (2016), “Financial Scarcity Amid Plenty”, Project Syndicate, 14 June With interest rates at all-time lows and central banks buying everything that moves, the world is awash with credit. Yet, paradoxically, a dangerous shortage of international liquidity is putting the global economy at risk. “International liquidity” refers to high-quality assets accepted around the world for paying import bills and servicing foreign debts. These are the same assets that central banks use …Read More

Liquidity, innovation, and endogenous growth

Semyon Malamud, Francesca Zucchi, (2016), “Liquidity, innovation, and endogenous growth”, ECB Working Paper 1919, Ιούνιος We study optimal liquidity management, innovation, and production decisions for a continuum of firms facing financing frictions and the threat of creative destruction. We show that financing constraints lead firms to decrease production but may spur investment in innovation (R&D). We characterize which firms should substitute production for innovation in the face of constraints and thus …Read More

How central is central counterparty clearing? A deep dive into a European repo market during the crisis

André Ebner, Falko Fecht, Alexander Schulz, (2016), “How central is central counterparty clearing? A deep dive into a European repo market during the crisis”, Bundesbank Discussion Paper No 14/2016, June Repo markets offering central counterparty (CCP) clearing and anonymized trading were remarkably resilient during the recent crises. We use the full transaction level dataset on all repo trades on Eurex Repo, including identifiers for market participants, to provide a detailed description of the …Read More

Why the Eurozone can’t agree on convergence. And how structural reforms can help

Anna auf dem Brinke, Henrik Enderlein, Jörg Haas, (2016), “Why the Eurozone can’t agree on convergence. And how structural reforms can help”, Jacques Delors Institut Policy Paper 165, 24 May It is common sense that the euro area needs more convergence to work as intended. At the same time, we lack a common definition. There are two important types of convergence that can both lead to a better functioning European Economic …Read More