Josh De Lyon and Swati Dhingra, (2019), “UK economy since the Brexit vote: slower GDP growth, lower productivity, and a weaker pound”, LSE EUROPP, 22 March Evidence of the UK’s economic performance since the EU Referendum is clear: GDP growth has slowed down, productivity has suffered, the pound has depreciated and purchasing power has gone down, and investments have declined. In this blog, Josh De Lyon and Swati Dhingra argue …Read More

Could Europe face the next recession?

Jan Priewe, (2019), “Could Europe face the next recession?”, Social Europe, 19 March That the eurozone is incomplete is an assessment shared by almost all economists and economic policy-makers. The prevailing opinion is that the European banking union is the most important missing part, in connection with a capital-markets union. A recent book, Still Time to Save the Euro, published by Social Europe, addresses six key economic problems which are …Read More

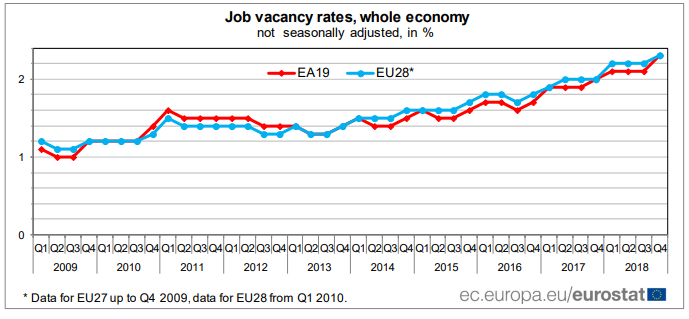

Euro area and EU28 job vacancy rates at 2.3%

Eurostat/Euro area and EU28 job vacancy rates at 2.3%/18 March 2019 The job vacancy rate in the euro area (EA19) was 2.3% in the fourth quarter of 2018, up from 2.1% in the third quarter of 2018 and from 2.0% in the fourth quarter of 2017, according to figures published by Eurostat, the statistical office of the European Union. In the EU28, the job vacancy rate was also 2.3% in …Read More

Whatever it takes: what’s the impact of a major nonconventional monetary policy intervention?

Carlo Alcaraz, Stijn Claessens, Gabriel Cuadra, David Marques-Ibanez and Horacio Sapriza, (2019), “Whatever it takes: what’s the impact of a major nonconventional monetary policy intervention?”, ECB Working Paper Series No2249, March We assess how a major, unconventional central bank intervention, Draghi’s “whatever it takes” speech, affected lending conditions. Similar to other large interventions, it responded to adverse financial and macroeconomic developments that also influenced the supply and demand for credit. …Read More

How Worrying Is the Recent Downgrading of German Growth Forecasts?

Alvaro Leandro and Jeromin Zettelmeyer, (2019), “Ηow Worrying Is the Recent Downgrading of German Growth Forecasts?”, Peterson Institute for International Economics, 15 March Growth in Germany has been very weak since the third quarter of 2018. The reason is a combination of one-off factors, including a drought and a new EU emissions testing procedure, which held back car sales last year, as well as cooling demand for German exports. As …Read More

What are central banks for?

Adam Tooze, (2019), “What are central banks for?”, Social Europe, 18 March The eurozone remains mired in unemployment while the European Central Bank targets only inflation. Adam Tooze begins a series of Social Europe columns by explaining the hidden history of the Fed’s more successful dual mandate. Relevant Posts Gregory Claeys, Maria Demertzis and Jan Mazzaa, (2018), «Monetary policy framework for the European Central Bank to deal with uncertainty», Bruegel, …Read More

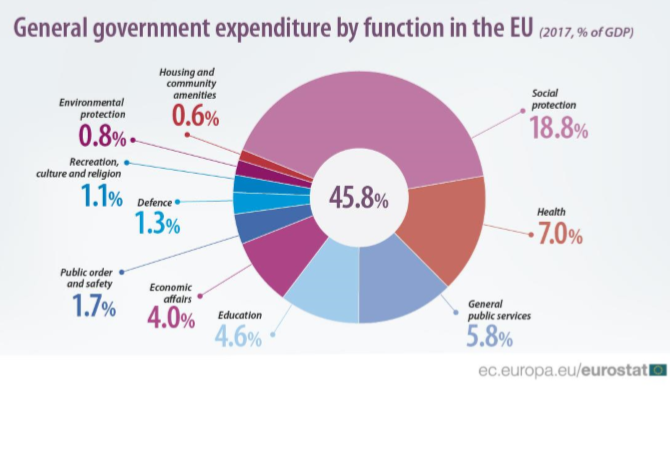

Highest proportion of government expenditure goes to social protection and health

Eurostat/Highest proportion of government expenditure goes to social protection and health/15 March 2019 In 2017, total government expenditure in the European Union (EU) amounted to 45.8% of gross domestic product (GDP). This share has steadily decreased since 2012, when it stood at 48.9% of GDP. Among the main functions of general government expenditure in the EU, ‘social protection’ is by far the most important, equivalent to 18.8% of GDP in …Read More

The European Union must change its supervisory architecture to fight money laundering

Joshua Kirschenbaum and NicolasVeron, (2019), “The European Union must change its supervisory architecture to fight money laundering”, 26 February Money laundering scandals at EU banks, often linked to Russia, have become pervasive. Reform of anti–money laundering (AML) supervision is urgent. Illicit actors have repeatedly moved billions of dollars through individual banks. This flow sustains the Kremlin’s patronage system at home by serving as an outlet for elites while it simultaneously …Read More

Monetary policy and the cost of wage rigidity: Evidence from the stock market

Ester Faia and Vincenzo Pezone, (2019), “Monetary policy and the cost of wage rigidity: Evidence from the stock market”, VoxEU, 12 March Policymakers are concerned about effecting real change with monetary policy, particularly in the context of wage rigidity. This column uses extensive Italian data to analyse the extent to which wage rigidity induced by collective bargaining amplifies the effects of monetary policy. The volatility of stock market returns reacts …Read More

ECB staff macroeconomic projections for the euro area

ECB, (2019), “ECB staff macroeconomic projections for the euro area”, March Real GDP growth remained unexpectedly sluggish in the fourth quarter of 2018, and recent indicators point to substantially weaker than previously expected activity also in the first half of 2019. While some temporary factors are likely to have contributed to the slowdown in activity in late 2018, the broad-based worsening of economic sentiment indicators across countries and sectors in …Read More