Gilles Saint-Paul, (2019), “From microeconomic favouritism to macroeconomic populism”, VoxEU, 7 March Macroeconomic populism typically leads to higher levels of public debt, public spending, deficits, and crises. Nevertheless, this column argues that it is rational for groups of voters to vote for a populist who reflects their interests, because they will be favoured when a fiscal adjustment occurs. The greater the fiscal adjustment required, the more likely voters are to elect a …Read More

Europe Isn’t Ready for the Next Recession

Bloomberg, (2019), “Europe Isn’t Ready for the Next Recession”, 8 March The European Central Bank surprised financial markets yesterday with moves to loosen monetary policy. The prospects for growth in the euro zone have dimmed lately, and policy was going to be tweaked at some point unless things picked up. But a change wasn’t expected so soon. ECB President Mario Draghi and his colleagues are apparently worried. Relevant Posts Ashoka …Read More

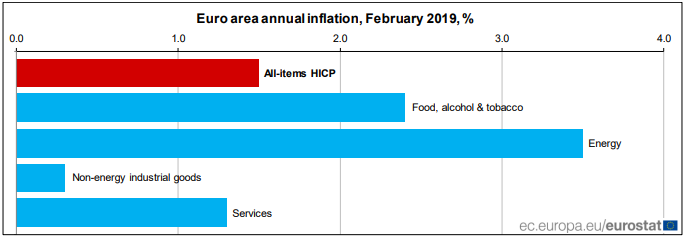

Euro area annual inflation up to 1.5%

Eurostat/Euro area annual inflation up to 1.5%/1 March 2019 Euro area annual inflation is expected to be 1.5% in February 2019, up from 1.4% in January, according to a flash estimate from Eurostat, the statistical office of the European Union. Relevant Posts Eurostat/Annual inflation down to 1.4% in the euro area /22 February 2019 Eurostat/Annual inflation down to 1.9% in the euro area/17 December 2018

The impact of population ageing on monetary policy

Marcin Bielecki, Michal Brzoza-Brzezina and Marcin Kolasa, (2019), “The impact of population ageing on monetary policy”, VoxEU, 5 March Population ageing is likely to affect many areas of life, from pension system sustainability to housing markets. This column shows that monetary policy can be considered another victim. Low fertility rates and increasing life expectancy substantially lower the natural rate of interest. As a consequence, central banks are more likely to …Read More

Trade and innovation: The Schumpeterian role of banks

Christian Keuschnigg and Michael Kogler, (2019), “Trade and innovation: The Schumpeterian role of banks”, VoxEU, 4 March Only strong banks can fulfil their Schumpeterian role by efficiently reallocating credit. The column argues that high capital standards, efficient bankruptcy laws, and a lower cost of bank equity improve credit reallocation and thereby support the productive specialisation of the economy. An efficient banking sector also magnifies the gains from trade liberalisation by …Read More

Portugal can use its economic recovery to build up resilience

OECD, (2019), “Portugal can use its economic recovery to build up resilience”, OECD, 18 February Portugal’s economic recovery is now well established, with GDP back to pre-crisis levels, a substantially lower unemployment rate and renewed investment and domestic consumption now joining a robust export sector to drive the economy. Efforts should now focus on reducing vulnerabilities to build resilience to future shocks, according to a new OECD report. Relevant Posts …Read More

Why the eurozone is going backwards

Paul Taylor, (2019), “Why the eurozone is going backwards”, Politico, 4 March The destructive beast of nationalism is back on the prowl in Europe’s banking sector. Seven years after European leaders agreed to crisis-proof the Continent’s banks by bringing much of the sector under the supervision of the EU, national governments and regulators are undermining the effort. Relevant Posts Jurgen Stark, (2018), «The Eurozone’s Solidarity Fallacy», Project Syndicate, 17 December …Read More

What to look out for in the latest European Semester package

Konstantinos Efstathiou and Guntram B. Wolff, (2019), “What to look out for in the latest European Semester package”, Bruegel, 26 ΦβερουαρίουFebruary Implementation of the European Commission’s country-specific policy recommendations (CSRs) is at a low rate overall. Whether this trend has continued, particularly among those countries judged to have excessive macroeconomic imbalances, will be evident in the soon-to-be-released reports of the Commission. Relevant Posts Steven Blockmans (ed.), (2019) “What Comes After …Read More

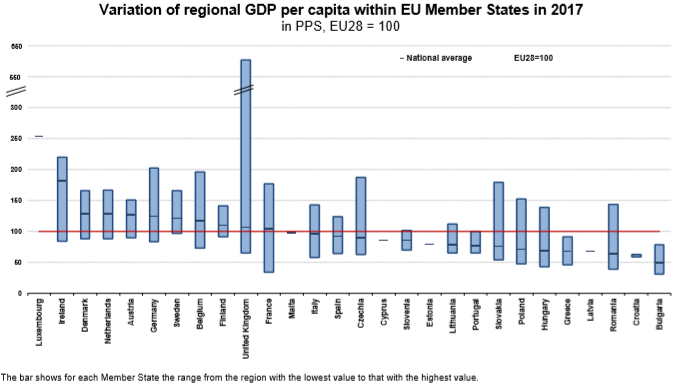

Regional GDP per capita ranged from 31% to 626% of the EU average in 2017

Eurostat/Regional GDP per capita ranged from 31% to 626% of the EU average in 2017/26 February 2019 In 2017, regional GDP per capita, expressed in terms of purchasing power standards, ranged from 31% of the European Union (EU) average in the Bulgarian region of North-West, to 626% of the average in Inner London – West in the United Kingdom. Relevant Posts Daniel Gros, Roberto Musmeci and Marta Pilati, (2018), «The …Read More

The ECB has reached its political limits. Its consequences in eight charts

Ashoka Mody, (2019), “The ECB has reached its political limits. Its consequences in eight charts”, VoxEU, 11 February In this post, Ashoka Mody documents the costs of ECB timidity, which, he argues, arises from the political limits on its actions. Relevant Posts Ferdinando Giugliano, (2019), «The ECB Has Policy Makers, Not Superheroes», Bloomberg, 22 February Marcus Ashworth, (2019) «ECB Is Awake and Asleep at the Same Time», Bloomberg Opinion, 19 …Read More